Amazon Prime Day drives Prime memberships and Amazon commerce lock-in

With 85 million members, Amazon Prime could be the most effective loyalty program ever.

Amazon Prime Day is in full swing. Among the standout deals are those on the Echo and Dot smart speakers, which will advance Amazon’s already large lead in the smart speaker/virtual assistant market. But beyond selling stuff, Amazon’s ultimate objective with Prime Day is to drive more Prime memberships.

In order to access Prime Day deals, you’ve got to be a Prime Member. According to Consumer Intelligence Research Partners (CIRP), as of the end of June, there are an estimated 85 million US Prime members. That’s up from an estimated 63 million in June 2016 and just over 40 million two years ago.

Source: CIRP (July 2017)

According to a Walker Sands “Future of Retail Survey” more than half (55 percent) of US consumers have used Amazon Prime in the past year. That’s extrapolated from consumer survey data (n=1,622) and suggests about 137 million Prime members (unless people are borrowing accounts), which is likely too high an estimate.

Nonetheless, it indicates the scale and awareness of Amazon Prime among internet users.

Source: Walker Sands (June 2017)

According to CIRP, Prime members spend more and buy more often from Amazon than non-Prime members. In fact, Prime subscribers spend almost twice what non-members spend: $1,300 per year versus $700 per year. Using CIRP’s membership estimates, that would mean Prime will drive nearly $110 billion in top-line revenue for Amazon on an annualized basis.

Whatever the actual numbers, Amazon has seen massive success since the launch of Prime in 2005. With expedited and free shipping and access to discount offers, it might be the most successful loyalty program ever.

According to Forrester Research, Amazon is the single largest ecommerce company in the US. While its impact on on traditional retail is often overstated, it’s clearly having an impact, as the shrinking time between ordering and shipping erodes the value proposition of physical stores. Many traditional retailers such as Macy’s, Best Buy, Sears, Walmart, Toys R Us, Crate and Barrel and others are trying to compete with Amazon today, offering their own deals effectively creating “Black Friday in July.”

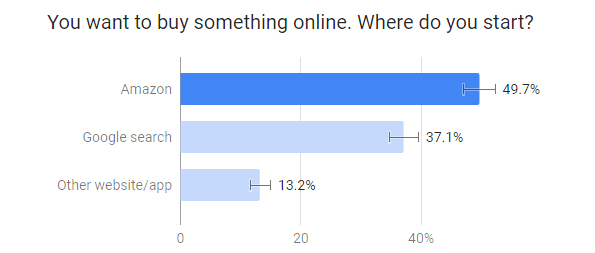

There’s no question that Prime has also boosted the Amazon brand. It’s now the place where roughly half of consumers start their search when they want to buy something online. That’s according to a recent survey conducted by Jolly Good Gifts, which is supported by other data in the market.

Source: Jolly Good Gifts (July 2017)

Prime is thus part of a virtuous cycle for Amazon. Prime Day drives Prime membership, which in turn generates more purchases and revenue for the company. Rinse and repeat.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech