3 lessons learned from 365,000 Amazon furniture & home goods product pages

What helps product pages stand out and spur conversions in this competitive category? Contributor Andrew Waber lays out the results of a recent analysis.

As in many markets, the tactics to successfully sell home goods and furniture on Amazon differ slightly depending on the price point. But after analyzing more than 365,000 furniture and home goods product pages on Amazon as part of my work at Salsify, I noted a few overarching lessons.

Top-performing products generally have product pages that quickly give consumers a robust view of what they might buy — particularly through imagery and reviews.

And perhaps most importantly, many home goods and furniture product pages across price points possess the bare minimum from a content perspective. For brands in this space that are willing to commit to improving their product pages, there is ample opportunity to outflank competitors.

Lesson #1: Focus on review counts, not so much on ratings

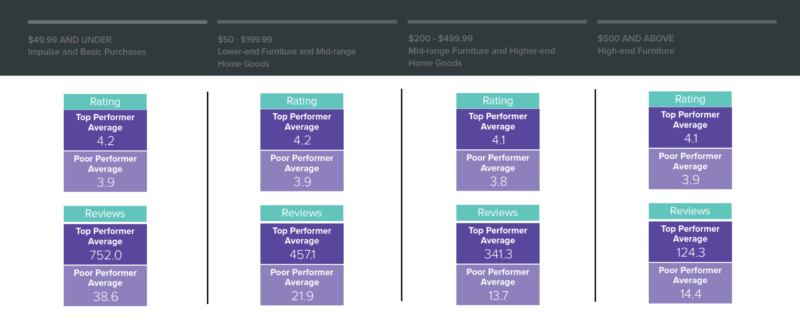

Within the report, we examined the average description length, bullet count, image count, ratings and review count of products within a specific price point segment. These were $49.99 and under, $50 to $199.99, $200 to $499.99 and $500 and above.

We then took “top performer averages” from the top 10 percent in sales rank at a given price point and “poor performer averages” from those in the bottom 10 percent.

Perhaps the starkest difference between these two groups, regardless of price range, is the average number of reviews. The top-performing product pages in the lowest price segment have an average of 752 user reviews, while at the highest price segment, the highest performers had an average of 124 reviews. Yet the average for poor performers never cracks 40 at any price level.

Yet, as seen above, these huge differences were much more muted in the average actual star ratings. This further underscores the importance of review count, which we’ve studied previously, and it emphasizes that while overall star rating is meaningful, it doesn’t necessarily move the needle as much as the raw number of reviews that support it.

Lesson #2: Aim to show, more than tell

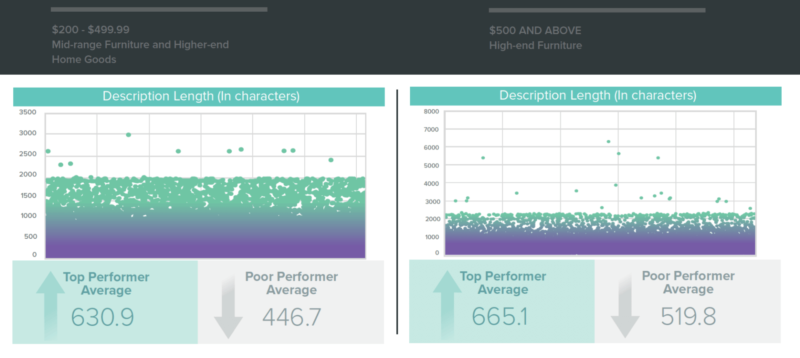

At higher price points, which weight more toward furniture and mid- to high-end home goods, top performers do have appreciably longer average description lengths. This emphasizes how consumers are more likely to spend additional time researching these items for things like measurements, quality and materials information.

But the differences between top and poor performers are mixed at the lower price points. In fact, poor performers actually had longer average descriptions than their top-performing counterparts in the $49.99-and-under range. Products at those levels tend to be less considered, like candles or individual glasses, making that initial image and above-the-fold content much more important than reviews to driving the purchase.

Meanwhile, throughout the report, furniture and home goods products in the top 10 percent of Amazon sales rank have an average of roughly five images on their pages. That total is two to three more images than average poor performers, depending on the price range.

Descriptions are important, but brands should be particularly focused on investing in rich imagery to power their product pages in order to get found and convert shoppers to buyers, regardless of price point.

Lesson #3: There’s a whole lot of ‘bare minimum’

Top performers may have roughly five images on average, but what’s striking when looking at the full distribution of image count by product page is the sheer number of pages with just one solitary image.

This is a tremendous opportunity for both established and new brands. Many potential competitors on Amazon are doing the bare minimum on something as meaningful as product imagery, which impacts A9 ranking, as well as the conversion rate once a consumer visits a page.

Beefing up the image count and quality, at least initially on high-volume or high-margin products that may be presently lacking, is a great way to jump-start performance.

It’s worth noting that over the past year, Amazon has worked aggressively to get more home goods and furniture products listed on its site. Largely driven by the desire to match Wayfair step-for-step, Amazon today boasts several hundreds of thousands of products across those categories, including those from its own private label brands. Wayfair, in turn, is responding with functionality similar to Amazon’s A-plus content.

Amazon and Wayfair are trying to win the online home goods and furniture market by being the place consumers want to shop for these items — due to convenience, assortment and a meaningful product page experience. In this environment, which is still rapidly growing and evolving, brands of all sizes have an opportunity to win, both in the near and the long term, by aggressively employing tactics that enable them to meet consumer needs on the product page better than their competitors.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories

New on MarTech