The calm before the storm: Why media channels die quickly

Columnist David Rodnitzky takes a look at the decline of newspaper ad revenue and the current state of TV and asks what it means for the future of digital advertising.

I recall an amazing chart I saw a few years ago about the decline in newspaper advertising revenue. Here it is:

If you’re like me, what you’ll notice first is the dramatic decline in revenue, starting around 2005. What I failed to notice, however, was that this decline was preceded almost immediately by the industry’s best-ever year — $65.3 billion around 2000.

I assumed that the dramatic decline was due to the rise of the internet — which is mostly true. But there’s another story here.

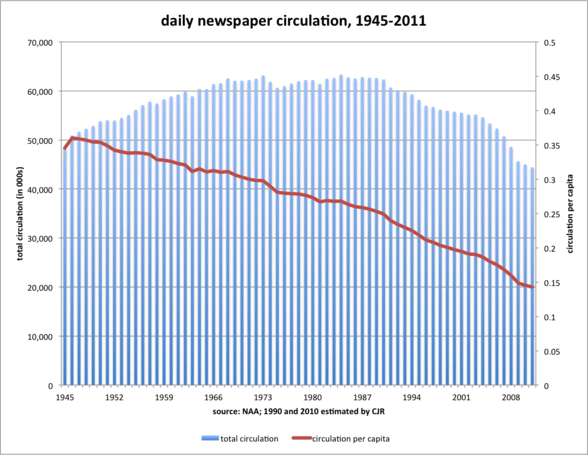

The internet had been taking market share away from newspapers since at least 1998, and yet revenue continued to rise quickly for newspapers. As the following graph from the Newspaper Association of America shows, newspaper readership hit a high note in 1990 — more than a decade before the rapid decline in revenue:

What this means is that since around 1990, advertisers were paying more and more per reader — in the internet world, we’d call this cost per thousand impressions, or CPM — until around 2005, when the advertisers got wise and started to pull money out. This is what it looks like when you combine revenue and readership (shown here as dollars made per reader):

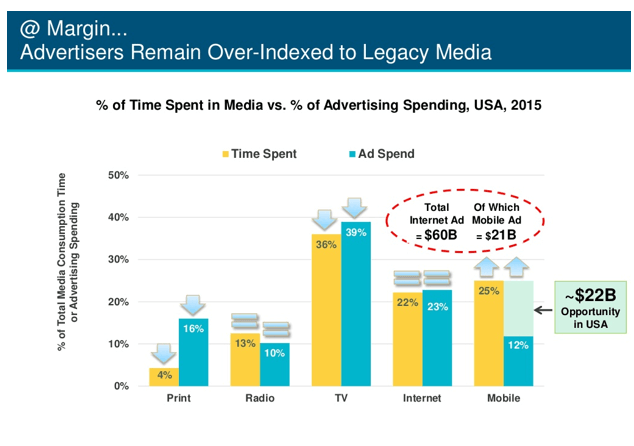

These charts show that advertisers are traditionally slow to move into new channels, which means that revenue is usually time-shifted to benefit traditional channels over new ones. Mary Meeker at Kleiner Perkins has observed this for years, as seen here:

Meeker suggests that the beneficiary of proper indexing will be primarily mobile, at the expense primarily of print (sorry, newspapers; the decline is not yet over) and TV.

The TV apocalypse is coming

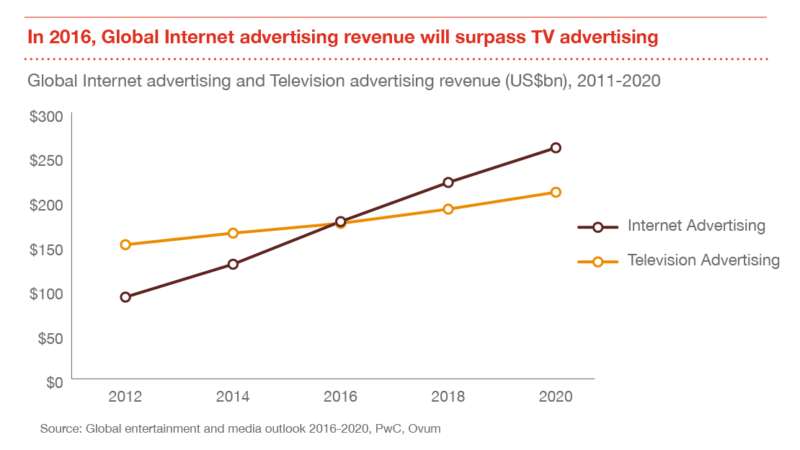

And indeed, the data seems to suggest that TV advertising is running into the same problem as newspaper advertising, with increasing revenue coupled with declining viewership. Here are the revenue predictions — even though internet advertising is now surpassing television, TV still continues to grow year over year:

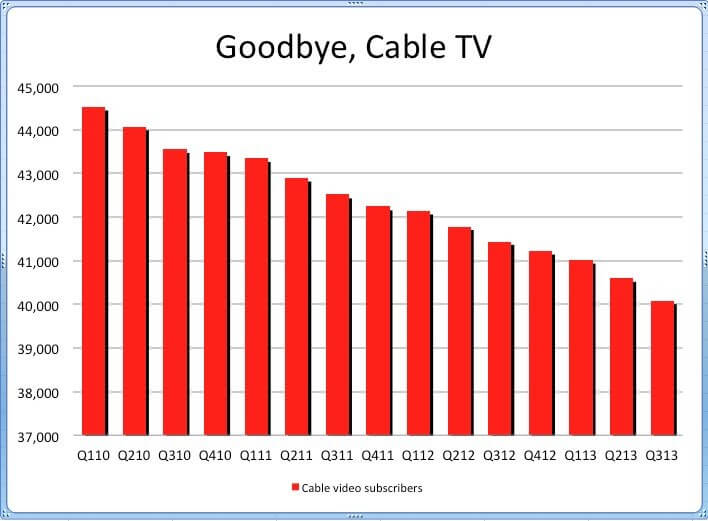

TV viewership, on the other hand, is on the decline. It was surprisingly hard to find charts that show the overall decline in TV viewership, but here are a few that are representative of the decline. First, from Business Insider, cable TV subscribers:

And check out World Series viewership (also via Business Insider):

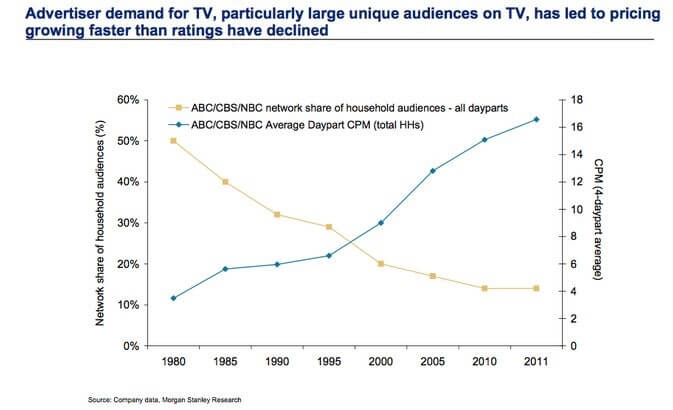

And then the killer graph — just as with newspapers, TV revenue is increasing because CPM growth is still outpacing viewership decline:

It should be pretty clear where this will end!

Let’s not get too smug

The digital media folks reading this have probably been smiling ear-to-ear and thinking, “It’s about time!” I’m not going to pretend that I don’t share many of these feelings, as I’m still shocked that digital is an afterthought to so many seemingly intelligent companies.

Of course, the lesson for us digital-first people is to remember that history has a knack of repeating itself. Note that Mary Meeker’s chart suggests that internet advertising spend is over-indexed — not nearly as much as print or TV, but over-indexed nonetheless.

There will come a day when something will replace the internet (and mobile) as the default medium — and the decline of internet revenue is likely to come as quickly as what has happened with newspapers and what will soon happen with TV.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. MarTech is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.

Related stories