What Apple Pay Means For E-Commerce Marketers

Columnist Jordan Elkind explores the ways in which Apple Pay might impact consumers, marketers, and competing technology giants.

What is common to McDonald’s, Whole Foods, Nike, Starwood, Groupon, and Uber? Answer: They are all launch partners of Apple Pay, Apple’s new mobile payment service for online and store-based retailers, announced a month ago and available to use as of earlier this week (October 20).

The new iPhone and iPad models — iPhone 6, iPad Air 2, and iPad Mini 3 — are the first devices embedding Apple Pay. These devices will enable consumers to pay with their phones or tablets online through the Touch ID interface using one’s fingerprint.

The iPhone 6 also includes an near-field communication (NFC) chip, enabling shoppers to pay using Apple Pay in physical retail stores. The new Apple Watch, available early next year, will also feature Apple Pay.

Image credits: Custora, The Custora Ecommerce Pulse

Let’s take a look at some of the factors that may have contributed to Apple’s decision to develop Apply Pay, and the implications for online retail marketers.

Why Apple Pay And Why Now?

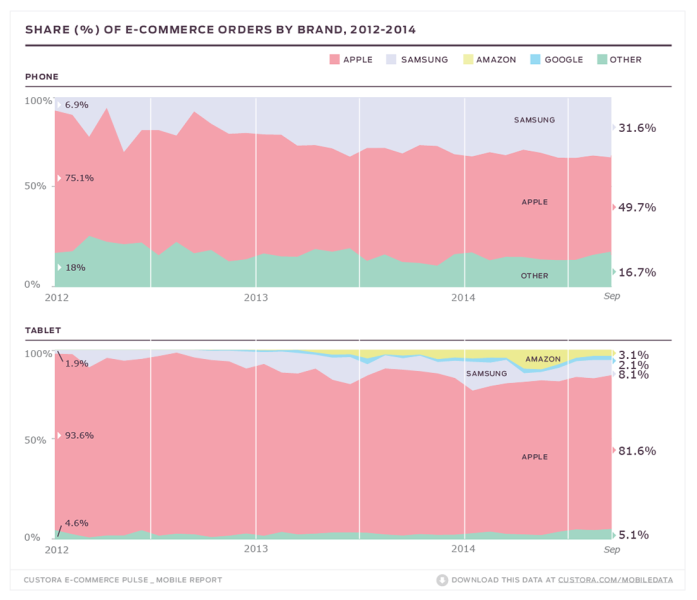

According to The Custora Ecommerce Pulse Mobile Report (from my company), Apple devices still dominate mobile ecommerce (online shopping done on phones and tablets).

In September 2014, almost half (49.7%) of online shopping done on mobile phones was done on Apple iPhone devices. Almost a third (31.6%) was done on Samsung phones, and the rest (18.7%) on other phones.

Image credits: Custora, The Custora Ecommerce Pulse

Tablet shopping presents an even rosier picture for Apple, with four out of five — 81.6% — of tablet ecommerce transactions done on iPads. Only 8.1% of tablet shopping is done on Samsung tablets, and the remainder is split between other tablet brands.

Apple’s Mobile Ecommerce Supremacy Is Being Challenged

While Apple still dominates mobile shopping, its supremacy continues to be challenged — most notably by Samsung, and more recently, Amazon. (And, let’s not forget Google.)

Over the last two years, Apple’s share of ecommerce orders done on phones went down from 75.1% in January 2012 to 49.7% as of September 2014. Samsung devices have more than quadrupled their share of orders over the same time period, growing from 6.9% in 2012 to 31.6% in 2014.

Share of orders made on Samsung tablets increased substantially in the past year-and-a-half: From 1.9% in January 2012 to 8.1% as of August 2014. Amazon has also quickly become a player, as purchases made on Kindle Fire tablets account for 3.1% of all tablet orders.

Apple Pay might slow down (or reverse) the trend of Apple’s declining mobile ecommerce share.

What Apple Pay Can Mean For Online Marketers

- Payment Ease. Paying directly with one’s phone offers convenience, speed, and security. These are all advantages marketers would love to tout to their customers as competitive differentiators. The Apple Touch ID mechanism can make those terrible payment forms all but disappear from online retailers’ sites — eliminating the need to optimize conversion at every step of the mobile checkout funnel.

- Cost Savings. Retailers now have more choices when it comes to accepting payments. Between Paypal, Amazon Payments and Apple Pay, online retailers have a choice. Competition is good for retailers (and consumers), and might lead to decreased fees and improved profit margins for online retailers. Apple Pay’s Touch ID paved the way to its lower (“Credit Card Present”) processing fees; the savings could be passed on to merchants, which in turn might choose to pass some of those to consumers.

- Promotions. Apple + Retailers = ? Over time, Apple might team up with retailers to offer deals and marketing promotions through Apple Pay. Apple said it was not going to keep any transaction data in its own database – it would all go directly to the retailer. It would be interesting to see if that changes in the future.

Final Thoughts

Apple Pay is now embedded in the new iPhone and iPad models including the iPhone 6, iPad Air 2 and iPad Mini 3. These devices enable consumers to pay with their phones or tablets online through the Touch ID interface with your fingerprint. The iPhone 6 also includes an NFC chip that allows shoppers to pay with Apple Pay in physical retail stores.

Early next year, Apple Pay will also be available in the new Apple Watch. All this means Apple Pay could revolutionize the way shoppers pay for goods online and in physical retail stores.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories