Special Report: Will People Ever Buy Through Social Media?

While Twitter and Facebook continue their in-feed Buy button tests, Pinterest and Instagram show promise as places where people are more motivated to make purchases.

Ecommerce and social media have been flirting for years with little to show for it, but the courtship is heating up. Both Twitter and Facebook are engaging in high-profile tests to bring the shopping experience directly into social streams.

Many third-party vendors already offer ways to plug ecommerce into the social media environment, mostly driving users to online storefronts with links in social posts. Now Facebook and Twitter are both working to make the experience more seamless, each experimenting with a Buy button that allows consumers to complete purchases with a click or two and without leaving the social network.

Those efforts beg at least a couple questions, however: How many people want to shop in the place where they go to connect with friends? Will many people pause to tap “Buy” while scrolling through discussions about current events?

Answers aren’t evident yet, but you can be sure that some will emerge in 2015. The potential market is too big to ignore. According to U.S. Census data, ecommerce has pulled in $293 billion in sales in the last year.

Shopping Via Twitter

After mostly ignoring transactional opportunities during its early years, Twitter jumped into ecommerce in earnest in February 2013.

The company’s first notable effort gave users the ability to make purchases with a Twitter-synced American Express card and tweeting with a specific hashtag, such as #BuyXBoxController.

It wasn’t a seamless experience, however. After tweeting the hashtag, users received a confirmation tweet from American Express, and to complete the deal they had to respond to that tweet within 15 minutes. Perhaps because of that clunkiness, the feature never gained traction and at some point, American Express quietly stopped offering goods for sale via the program. Today users can load discounts onto their cards by tweeting specific hashtags.

Ecommerce giant Amazon also has hashtag-based integrations with Twitter. When a user puts #AmazonCart in a reply to a tweet that includes an Amazon product link that product is added to his or her Amazon cart. Similarly, using #AmazonWishList in a reply adds items to a user’s wish list on the site.

Again neither are the most frictionless way into consumers’ pocketbooks. And that’s no doubt why Twitter is working hard to hone its native solution before a full-scale launch. The company has been testing a Buy button in tweets since September, working with a handful of ecommerce platforms such as Fancy, Gumroad, Music Today and Stripe and a selected group of brands, artists and non-profit organizations.

Twitter seems to have nailed the user experience, which you can try out on the example above from the Nature Conservancy. When someone sees a Buy button and clicks on it, he or she is prompted to fill out a form with credit card information and a shipping address. After that the transaction can be completed with two more clicks, including one to confirm the order. Twitter stores the billing and shipping information, so subsequent purchases only require several clicks (or taps on the mobile app).

But usability is only a tiny part of the battle. The larger issue is whether people will actually use it.

Are they using it? We asked Twitter to share usage data from testing but a spokesperson declined. Clearly, though, the company is pushing forward. In November it launched another ecommerce test, Twitter Offers, that gives advertisers a way to offer virtual coupons within promoted tweets. The offers are loaded directly to consumers’ credit or debit cards and are automatically applied when purchases are made. The product, based on technology developed by Twitter acquisition CardSpring, allows businesses to track when their ads on the network are leading to sales.

Another indication of Twitter’s ecommerce momentum came this month when Hachette Book Group partnered with Gumroad to sell books via the Buy button. And it was a rousing success for at least one author, Amanda Palmer, who offered a signed draft page of the manuscript of her new book to the first 100 people who bought it through the tweet. As you can see, Palmer was very pleased with the results:

100 books sold in 20 minutes using Twitter! one small step for an artist, one giant step for artistkind. I hope this tool helps many people.

— Amanda Palmer (@amandapalmer) December 11, 2014

That type of scarcity and exclusivity offered by a very popular artist (Palmer has more than a million Twitter followers) represents a perfect mix for tapping into social commerce. But Twitter hopes it will scale to less blockbuster efforts also.

One of the keys to doing that, Twitter’s head of commerce Nathan Hubbard told Business Insider, will be using Twitter’s “interest graph, geo data and contextual data” to make sure people are being served buying opportunities when they are in the purchasing mood.

And tapping into Twitter’s in-the-moment nature could prompt impulse buys, something that Twitter president of global revenue Adam Bain touched upon during a presentation at the Web Summit in Dublin in November.

“People are tweeting about products and services, but there’s a big distance between that and actually making a purchase,” he said. “American Express and Amazon have already brought ecommerce closer to tweets. We saw this as a great organic experience, and we decided to shrink that experience. If you’re tweeting about a product or service, a button shows up and you can one-click to buy.

“We’re experimenting with different products and price points, and most importantly what emotions do you need to find to generate a sale. What we do is monetize emotions.”

Shopping via Facebook

If Facebook appears to be moving more slowly with ecommerce, it’s partly because the social network’s efforts in the arena have been marked by splashy failures.

The most notable example: the Facebook store program that it launched in the pre-IPO days of 2011. The Gap, J.C. Penney, Nordstrom and GameStop all opened and closed Facebook stores within a year. Companies complained that they weren’t seeing enough ROI and that creating a shopping destination on Facebook proved to be redundant.

“It was basically just another place to shop for all the stuff already available on the retailer websites,” digital strategist Wade Gerten, who launched a Facebook store for 1-800-FLOWERS.com, said at the time. “I give so-called F-commerce an ‘F.'”

Facebook Gifts, another attempt at direct sales, lasted longer but also didn’t last. After starting it in September 2012 as a way for people to send trinkets to friends, Facebook dropped physical products from the program last year, focusing on selling gift cards to companies such as Starbucks and Target. Then in August it shut Gifts down entirely to focus on its main commerce efforts.

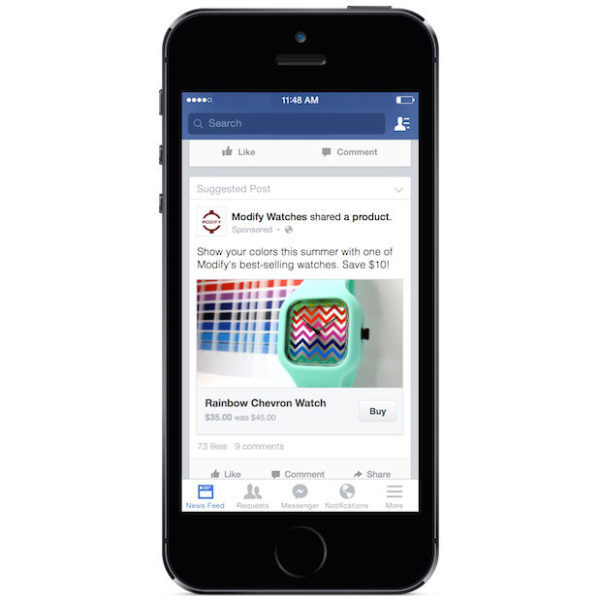

Those efforts are mostly being done without fanfare. Facebook announced its Buy button test in July, saying it would be offered to a few small and medium-sized business in the United States. Unlike Twitter’s testing which is being doing in public with a fairly sizable group of partners, Facebook is playing it close to the vest. It hasn’t released the names of companies in the test and we couldn’t find any Facebook Buy button examples in the wild. (The above image is a sample from Facebook’s blog post announcing the test.)

And despite heavy demand from advertisers hoping to cash in on the lucrative holiday shopping season, Facebook isn’t budging on its slow-play strategy.

“We are very clear,” Facebook’s head of ecommerce Nicolas Franchet told Bloomberg last month. “It’s a small test, limited to the test, and our job is to continue testing.”

Franchet said Facebook doesn’t want to confuse retailers by offering something that it later might have to take away. Instead, the company is pitching standard ads with links to shopping sites.

“We don’t want to complicate the picture for them,” Franchet said. “The ‘buy’ button gives them a glimpse of where we may be going in the future — but maybe not.”

Meanwhile, Facebook continues to press ahead with more subtle commercial options. Since February, advertisers have been able to insert call-to-action buttons — Shop Now, Learn More, Sign Up, Book Now or Download — into News Feed posts. This month, it gave Facebook Page administrators the ability to add similar buttons to the top of their Pages.

Facebook also has a payment and shipping infrastructure in place, built to serve its previous ecommerce efforts. Currently payments are primarily used for in-game app purchases but the company also offers app developers the ability to tie into the payment system. That process, called Autofill, got a big boost in April when Facebook signed an agreement with Ecwid, an ecommerce platform provider that supports 600,000 online merchants in 175 countries.

Clearly, Facebook aims to stay in the ecommerce mix, as COO Sheryl Sandberg noted on the company’s July 23 earnings call, the company believes it will be a major player:

“Commerce is really important and is a growing important part of our business. The more people buy online, the more people buy things they discover through their mobile phones, the more people discover things from News Feed and go on to purchase, the more important we are in driving ecommerce, and I think we are increasingly important.”

But Does Anyone Want To Shop On Social Media?

Many analysts still doubt that Facebook and Twitter will prove to be major ecommerce players. As general interest networks, the thinking is that most people go there for reasons other than shopping. And history is damning. As Chris Dixon, an investor at Andreessen Horowitz, explained the failure of Facebook stores in 2012: “Facebook is like Starbucks where everyone hangs out but no one ever buys anything.”

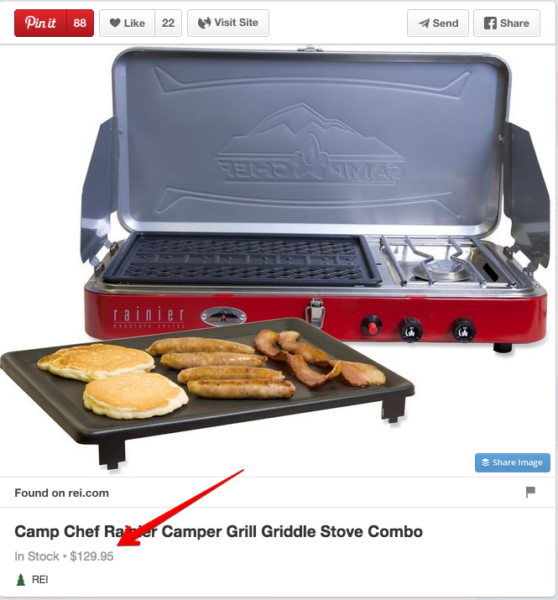

Pinterest, on the other hand, doesn’t face that perception. People flock to the social bookmarking site to explore products that they might want to purchase. Pinterest says two-thirds of its content — last reported in April at more than 30 billion pins — comes from businesses. Pinterest isn’t currently working on a buy button but its Rich Pin feature shows pricing and availability of items from ecommerce sites. And people who pin a product get email alerts if a price drops.

Instagram is also seen as a discovery engine and several third-party vendors have created workarounds that make Facebook’s visual social network shoppable. Curalate’s Like2Buy, for instance, enables users to bookmark their Instagram likes on a custom landing page. Curalate CEO Apu Gupta says brands using the service are seeing 60-70% click-through rates.

Gupta believes Buy buttons are part of a trend of ecommerce transactions being decoupled from retail sites.

“Gumroad allows you to have a shopping cart anywhere,” Gupta said in an interview with Marketing Land. “Somebody can take products from a brand put it onto a blog and affiliate link there and actually clear the transaction remotely. So you are going to see a broader distribution of places in which transactions can happen. That’s going to include social but I think it’s going to favor certain social networks over others.”

Sucharita Mulpuru, an analyst with Forrester Research, believes that Pinterest and Instagram will probably be the most favored networks. She’s more pessimistic about Facebook and Twitter because she said most purchases aren’t “random impulse buys” and that Google search is usually the final step before a sale, “which is why Google search is so powerful for commerce.”

However, she said, there might opportunities for sales of items with short shelf lives, such as concert or movie tickets, and relatively low friction. To Malpuru Facebook seems like a better bet than Twitter because the latter is so news heavy and fast moving. The ability to target posts in Facebook’s News Feed, has her believing that a Buy button could work better than previous Facebook ecommerce attempts, but she’s still skeptical.

“All this is speculative, right? The data that we have says that social commerce sucks,” Mulpuru said in a telephone interview. “So the question is: Does it still suck or is there maybe promise? And what we are saying is well there may be promise with these discovery engines. None of them have proven anything yet; no retailers are telling us a different story.

“So the story hasn’t really changed; the only thing that’s changed is that discovery engines exist and there are some new products out there potentially with the Facebook Buy button that are different. We’ll see.”

In other words, social media’s relationship status with ecommerce remains an unsatisfying “It’s complicated,” but there are signs that we’ll have more clarity on the matter in the near future.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories