Tune study: Overwhelming number of mobile users won’t pay even $1/year to avoid ads

Only 4.5 percent of users would account for more than 80 percent of voluntary payments -- which would be 9 percent of what mobile web publishers now get from ads.

Some makers of ad-blocking software pitch the idea that the web was really meant to be a place where users voluntarily pay for content, instead of being compelled to endure ads.

Case in point: last week’s announcement of a joint project between Adblock Plus and content-funding tool Flattr, creating Flattr Plus. It sets up a user-funded pot of money that is automatically shared by participating sites, according to some to-be-defined metric of engagement and attention.

In a statement accompanying the announcement, Flattr (and Pirate Bay) co-founder Peter Sunde said that Flattr Plus is intended to “finally evolve the web into what it was supposed to have been to begin with: a place for creators to meet their audience, and a mechanism for audiences to directly and sustainably support creators.”

There’s just one problem, according to a recently released study by mobile marketer Tune.

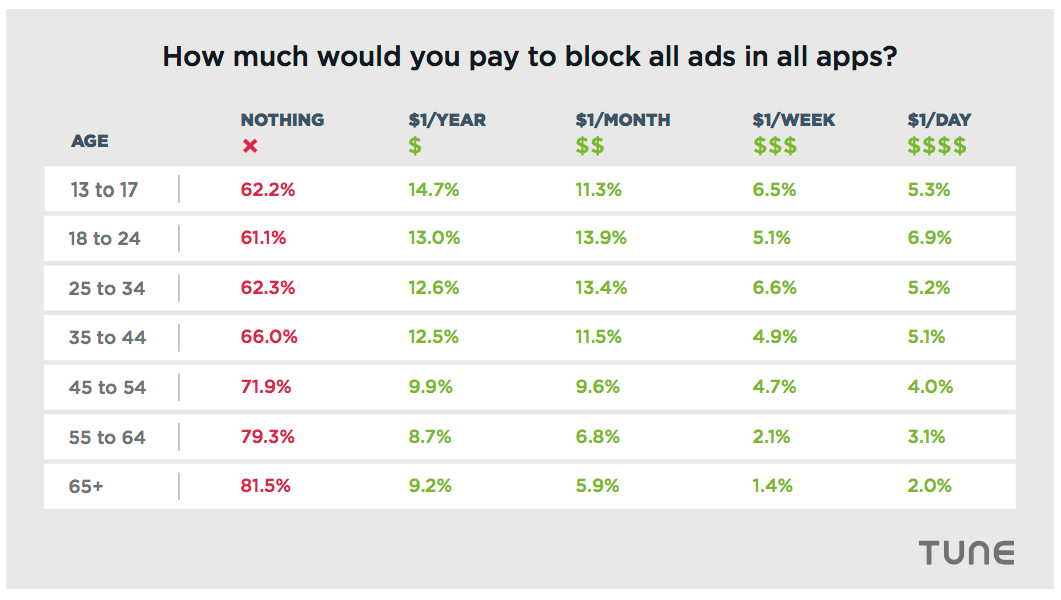

In the mobile world — where ad blockers have been popular because of load times and other usability issues — nearly 70 percent of users don’t want to pay anything.

The Seattle-based Tune surveyed almost 4,000 users in the US and UK. In a nutshell, according to Tune mobile economist and study author John Koetsier: most mobile users “won’t pay even $1/year to avoid mobile ads.”

Only 4.5 percent of respondents would be willing to pay $1/day, and the same percentage was willing to alternatively pay $1/week. Asked about $1/month, 10.4 percent said yes, and 11.3 percent said sure to a whopping $1/year.

Koetsier added that the total of all the contributions that respondents said they would voluntarily pay would be about nine percent of what publishers are getting now from mobile ads.

When Flattr and Adblock Plus made their announcement last week, an Adblock Plus exec told TechCrunch that his company’s millions of ad-blocking users “have been the most vocal in asking for solutions like this,” to voluntarily pay publishers without ads.

Not so for mobile users, the Tune study says. Ad-blocking users were found to have the same lack of interest in voluntarily making payments as regular users.

Tune found that 68.3 percent of non-blocking smartphone users would not pony up even a dollar a year. For ad-blocking smartphone users, the non-payers total 67.4 percent.

The real issue, Koetsier told me, is that the percentage of voluntary payers at any frequency is “not significantly larger for people using ad blockers.”

There might be a tiny ray of hope for those who wish the web to become ad-free. The Tune study found that younger users — although they hold less bling than older users — are also slightly more willing to pay. But even those younger users do not get anywhere near the levels needed to replace ads.

The study shows that a small number of users would be carrying the bulk of the revenue load. About 4.5 percent would fork over almost 82 percent of the revenue, for an annual total of $3.62 billion.

But, according to eMarketer, mobile ads currently generate about $42 billion annually, which is on target to become nearly $70 billion within three years.

A study from Juniper Research, out yesterday, found that ad-blocking software could cost digital publishers $27 billion by 2020.

It’s not like users don’t realize the value of the ad-supported content they’re getting. A new survey by Zogby Analytics, also released Wednesday, found that Americans assigned a value of almost $1,200 annually per person to the ad-supported service and content they currently get free online, because of ads.

And 85 percent said they preferred an ad-supported model to paying for content. The survey was conducted by the Digital Advertising Alliance, with responses in April from 1,004 adults in the US.

Tune says that 25 percent of smartphone owners have installed an ad-blocking app or browser. Koetsier pointed out that mobile ad blockers are primarily designed for websites, since ad blocking of apps is much more involved for the user and often requires routing the ads through a virtual private network (VPN).

App publishers will often remove ads if you upgrade to a paid version, but that means maintaining two versions. Or publishers will sometimes remove ads if you buy something in-app, although the required levels of purchases vary.

In addition to blocking annoying or slow-loading ads, one reason cited for the use of ad blockers is that smartphone users want to limit the amount of data collected on them. But the Tune report pours some cold water on that theory, by pointing out that the adoption rates of built-in functionality to limit ad tracking on iOS and Android devices are dropping.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories