Survey: Smartphone Shopping Behavior Changes By Store Category And Price Of Product

We’ve known for quite some time that smartphones are heavily used by consumers while shopping. As much as 80 percent of smartphone owners use or have used their devices in stores while shopping. They’re typically used to check prices and read product reviews (top 2 use cases). Many people often look for discounts or coupons […]

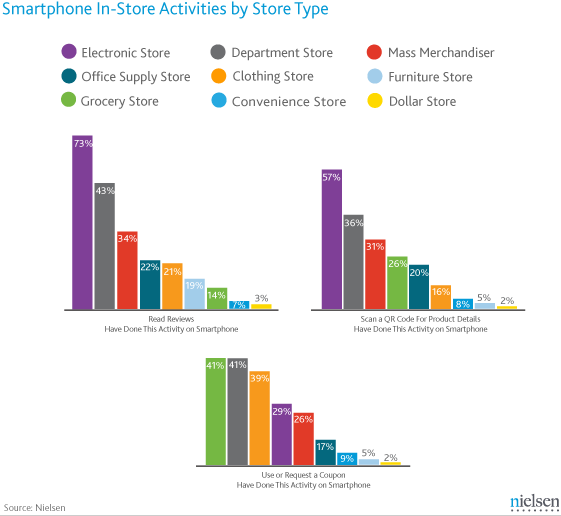

They’re typically used to check prices and read product reviews (top 2 use cases). Many people often look for discounts or coupons on their phones as well. Nielsen adds some additional nuance to those broad observations with survey data that reflect different types of usage by store category.

Nielsen says its survey data reveal that smartphone usage while shopping changes by type of store and according to whether the product is more expensive. In other words, ” The more considered the purchase, the more smartphone shoppers rely on their smartphones,” according to Nielsen.

As the data above reflect, people appear most interested in reading reviews in electronics stores and “department stores.” Equally they scan QR codes in those environments more than the do at a “clothing store.” Coupons (request or use) appear to be most widely used in grocery stores, department stores and clothing stores.

If one steps back all this makes sense. There’s no new behavior here really. Consumers are simply “importing” long-established internet usage patterns into the store through the smartphone. Barcode and QR scanning in one sense is new and unique to smartphones, but it’s actually just a kind of search or product lookup in a slightly different form.

Last week Nielsen also released data from the same survey on differences between how consumers use smartphones and tablets (iPads) in shopping — in all contexts.The areas where there were the largest differences in behavior were in the use of store locators, product research before purchase and actual ecommerce. In this context tablet behavior is more like (but not identical to) PC usage.

There are not necessarily any new takeaways for marketers beyond the affirmation of the importance of these devices in consumer product research and shopping — an already well-established fact.

However, if you’re a retailer or an agency working on behalf of retailers, the data in the first chart may in fact hold some interesting implications for how you address smartphone usage in stores — beyond the basic idea that retailers must embrace and not fight these consumer patterns.

Finally we can expect all these behaviors to continue to develop and become more mainstream over time. Marketers generally are lagging far behind consumers in terms of their adaptation to these behaviors. There are now well over 100 million people in the US using the mobile internet on a regular if not daily basis, yet the majority of brands and marketers still don’t have a mobile optimized online presence.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories