Report: Google’s 7-Inch Tablet To Be Cheaper Than Kindle Fire

There’s a great deal of discussion this morning about a DigiTimes report that Google’s forthcoming “highest quality” tablet is a 7-incher. Accordingly, the thesis is, the tablet has Kindle Fire in its sites rather than the iPad. This is the point I made earlier this week in a post entitled, Google’s Coming Tablet: A Response […]

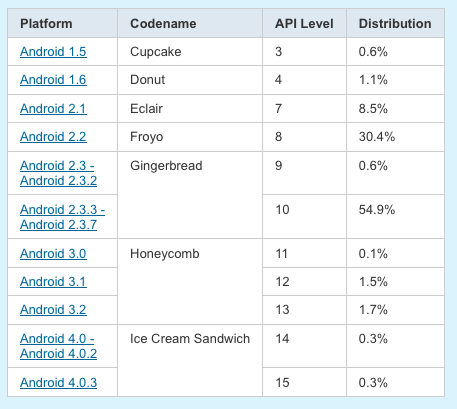

My argument was that Google’s other OEM partners have failed to produce successful Android tablets; new data show that only 3.3% of Android devices running the “tablet version” of Android: Honeycomb. (There are Android tablets running earlier versions of Android but not many.)

Google’s Andy Rubin has previously said there were six million Android tablets “out there.” There are estimates in the market that Android counts between 200 and 225 million active users (including tablets). Using those figures and the data above we can estimate that between 6.6 million and 7.4 million Android tablets have been sold/activated on a global basis. This would include Kindle Fire tablets, which probably number between 3.5 and 4 (or so) million sold to date.

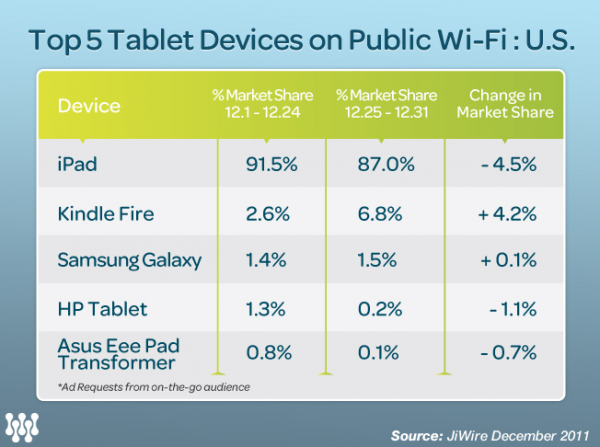

However if one looks at actual usage data, excluding Kindle Fire, Android tablets have much less than 5 percent market share.

Kindle Fire right now is the only Android tablet with any real traction. But there are ways in which Kindle Fire is not a “true” Android tablet: 1) users can’t access the Android Market easily and 2) Android could sell default search on its own browser to Microsoft.

This is a major threat to Google in an increasingly important hardware segment. Hence Google’s direct push into tablets. According to the DigiTimes report:

The sources believe that Google will launch the own-brand tablet PC in March-April, featuring a 7-inch panel and Android 4.0 with a price less than US$199 to compete against Amazon.

If the report is true — and Google delivers a great Google-branded 7-inch Android tablet for less than Kindle Fire — consumers will cheer and it will fly off the shelves. Google could sell millions quite quickly.

By the same token a quality Android tablet for (say) $149 would, to use the vernacular, “piss off” Google’s OEM partners trying to sell their own Android tablets. But it could also achieve its objective: to cool down Kindle Fire sales. In that scenario the Android tablet market would effectively become a two (or three) company segment: Amazon, Barnes & Noble and Google (Motorola?).

Not being able to make a profit on the devices, Samsung, Sony, Asus, Dell and virtually all others would probably exit rather than fight a losing battle in the 7-inch segment. But the $199 Kindle Fire also makes it hard to sell larger tablets profitably too. That’s because once you get close to the $499 price of an iPad you simply lose the sale to the superior device.

I haven’t used Ice Cream Sandwich on a tablet and so can’t speak to the user experience. But the Honeycomb experience on a Samsung Galaxy Tab 10.1 is quite disappointing (even grim) by comparison to the iPad. This is largely because there are very few tablet-specific Android apps.

The gap between the Android tablet and iPad experiences is less “obvious” on the smaller, 7-inch device. This is probably another reason that Google would attack that category first.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories