Google’s new HR product is a game changer: Which industry is next?

With Google Hire, the search giant is invading shopping, travel and recruitment. Columnist Nate Dame explains why it all comes down to ads -- and why it's time to start thinking about how Google could affect your long-term goals.

A comparison of applicant-tracking systems on Software Advice lists 260 products. But there’s a new product to add to the list — a product from the world’s most valuable brand that seeks to narrow the competition in the field. Meet Hire by Google.

Hire is an applicant-tracking tool that’s available to companies with 1,000 or fewer employees, and it’s built to work with G Suite applications like Gmail and Google Calendar. In a blog post announcing Hire’s official launch last month, Google says:

[blockquote]Hire and G Suite are made to work well together so recruiting team members can focus on their top priorities instead of wasting time copy-pasting across tools.[/blockquote]

When it says, “wasting time copy-pasting across tools,” Google means those other 260 systems that SMBs (small to medium-sized businesses) might currently be using as recruiting and applicant-tracking solutions. The HR SaaS (software as a service) industry is, understandably, in a bit of a panic. (We should know: Jobvite has been a long-term client of ours, and we can absolutely confirm that this is the biggest SEO news we’ve dealt with in years.)

Hire is just one of a series of invasions of verticals by Google in recent years, but it’s notable because it’s the first time Google has targeted a B2B or business SaaS technology category with its own software offering (correct me if I’m wrong here, @seonate). It’s significant, and business owners and company executives should take note.

A brief history of notable deep vertical products by Google

Hire isn’t the first instance of Google invading a vertical, but past intrusions have only targeted B2C industries.

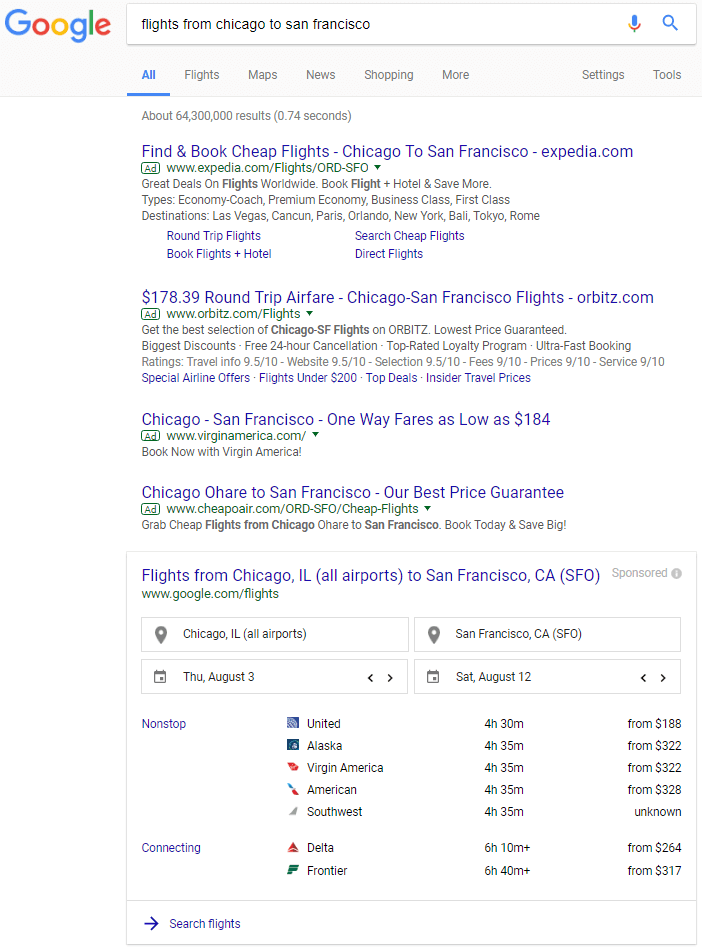

- Google Flights was released in 2011. In search, Google Flights appears below AdWords ads, but above all organic listings — and it’s much larger and more detailed than the subsequent organic listings.

-

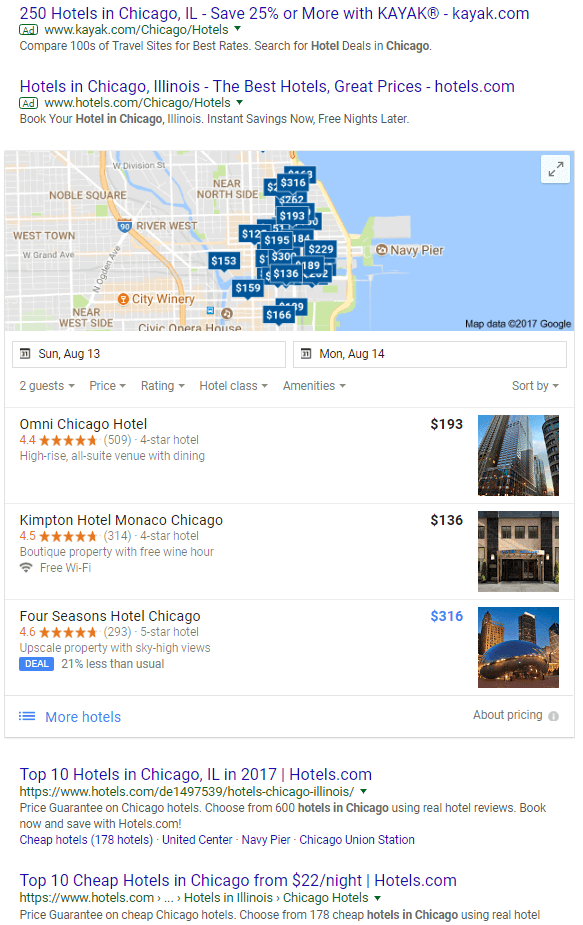

Google Hotel Finder was originally released in 2011, but it was retired as a tool in 2015 when the functionality was integrated directly into Google Maps. Another invasion of the travel industry, Google Maps hotel listings appear in the same position as Google Flights — below ads but above organic results.

Of course, Google Maps in and of itself is a pretty significant invasion of the local/directory vertical, adding functionality over time — like user reviews, restaurant menus and appointment-setting — to compete with sites like Yelp and TripAdvisor.

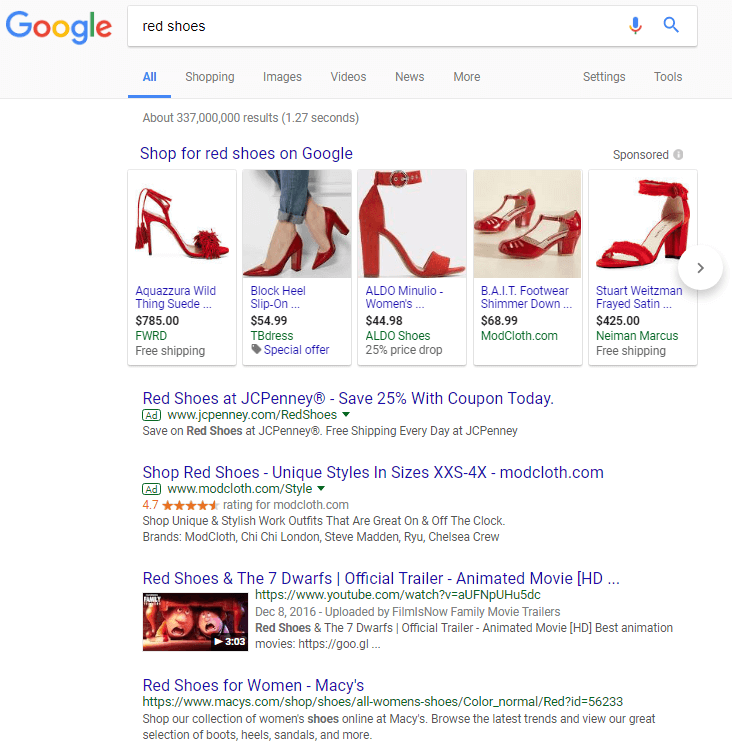

- Google Shopping was released in 2012. Unlike earlier versions of the product comparison tool, Google Shopping was notable because of the shift to an entirely paid model — sellers must pay to have their products listed. Google was recently fined by the EU for using its control over search to place its results above those of competitors, a violation of antitrust rules. The Google Shopping carousel appears above both ads and organic results in search.

Why these industries? Assess your risk by understanding Google’s business case

Shopping, travel and recruitment all have four things in common that make the verticals appealing to Google:

- They all have high search volumes. In terms of total search traffic in the US, the shopping, career and travel industries receive significantly more searches than other verticals.

- They all generate significant AdWords revenue. In both 2011 and 2014, shopping (#2), travel (#3), and jobs (#4) were among the highest-spending industries on AdWords, topped only by finance and insurance in the number one position.

- They’re all transactional. Shopping and flights lead to a purchase. Hotels lead to a reservation. A job search leads to an application, and recruiting leads to an interview and a hire.

- They all represent a lot of data. Shopping data tells Google who you are, what you like and who you buy gifts for. Flight and hotel data gives Google an idea about your income level and travel interests. Career data is massive — containing education information, professional work histories, career interests, professions and network contacts.

It works like this:

- Google releases its own product/platform/feature and claims a significant portion of the massive amounts of traffic that these verticals earn.

- It uses the high traffic volumes to entice businesses in that industry to advertise things like hotels, flights or products.

- It retains its ad customers by providing conversion data. Since the verticals are transactional, Google can provide specific numbers of reservations made, flights booked, sales completed or applications received.

- It collects data from each user interacting with the platform to build more detailed user profiles that can be used to sell more targeted advertising and serve more personalized ads.

In the end — as it so often does with Google — it all comes down to ads. Shopping, flights, hotels and now recruiting — each represents significant opportunity to sell ads. Before too long, I predict that Google will being selling premium job listings that appear in its new Google for Jobs search engine, and it will use the data gathered from Hire to optimize ad targeting on that platform.

You might be thinking, “But what about G Suite and Google Cloud? Those core SaaS offerings have been around for years — and come with a lot of data — but Google hasn’t monetized them.”

The major difference is that G Suite and Cloud are very broad offerings. On the other hand, Google Hire and Google for Jobs are targeted to a single industry, making it much easier to attract advertisers looking to market to a very specific audience.

Which industry is next?

B2B industries are no longer safe (and B2Cs haven’t been for years now). At any time, Google could launch a new platform, product or feature and become a competitor in any industry. But take note: Google is more likely to be interested in verticals with high search volumes, transactional opportunities and big data — those that are primed to generate significant ad revenue.

If your industry meets one or two — but not all — of those criteria, you’re probably safe for now. But if it meets all the criteria, now is a great time to start thinking about how Google as a competitor could impact your long-term plans and goals.

Just like planning a growth strategy or a negative press communications strategy, taking time to figure out how to deal with a surprise, massive, fierce future competitor is a worthwhile exercise for any executive.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories

New on MarTech