Google Wallet Gets Its Second US Carrier — AT&T

When Verizon said in December that it was blocking Google Wallet on the Galaxy Nexus handset, because of “security concerns,” conspiracy theories abounded. Verizon is an investor, along with AT&T and T-Mobile in ISIS, a mobile payments competitor of Google Wallet. Verizon denied that it was “blocking” customers from accessing Google Wallet. Rather the company said […]

Verizon denied that it was “blocking” customers from accessing Google Wallet. Rather the company said it was merely delaying availability until its security concerns could be resolved. Never mind that Sprint never raised any comparable security concerns about Google Wallet with the Nexus S, which has been in the market for roughly a year.

Security as pretext?

At the time I speculated that if Verizon was being anti-competitive because it wanted to prevent Google Wallet from getting too much of a “head start,” then so would its ISIS partners AT&T and T-Mobile. Yesterday, however, Android Community reported that Google Wallet became available for download for the AT&T version of the Galaxy Nexus.

The Sprint Nexus S is still the only phone in the US that officially offers Google Wallet. Indeed, no official announcement has come from AT&T. The writer at Android Community made the discovery while poking around in the Android Market. It’s also not clear how visibly the carrier will promote Google Wallet. Yet this probably means that Galaxy Nexus customers on Verizon will also gain (eventual) access to Google Wallet.

The mobile payments race has begun in earnest

Google Wallet relies on near-field communications (NFC) to conduct payments. (NFC is a technology that can be used much more broadly than for just payments.) Google Wallet competitor PayPal is taking a different approach, in a test with HomeDepot, using a system that doesn’t require an NFC chip. Instead, PayPal simply requires a user to enter a pin number and her phone number to trigger a payment in a local store.

Startup Square also doesn’t require consumers to have NFC-enabled phones to pay with its “Card Case” app. However merchants must be using the Square card reader/system in order to accept Card Case.

The forthcoming update to Windows Phones (Windows Phone 8) will apparently support NFC. Rumor has it that the iPhone 5 handset will also offer NFC capability.

There’s now significant momentum around mobile payments and mobile wallets. And while the market will be big enough to support multiple competitors there will be winners and losers. Google is certainly poised to be one of the winners provided it can gain distribution — and consumer trust.

Who’s most trusted?

There are conflicting survey data about which entities consumers would trust most with mobile payments. A recent survey from accounting and consulting firm KPMG found financial institutions (i.e., banks, credit card issuers) were the most trusted category (56 percent), while PayPal was also trusted by a significant minority (30 percent) of respondents:

Despite the readiness to adopt new technologies, as well as the surprising willingness by consumers to have their personal data tracked, the survey showed that yet again, the most significant barrier to new digital models continues to be concerns over data privacy and security. The number of people concerned about these issues has increased from 75 percent to 90 percent . . .

When asked who they trusted most with their payment data, 56 percent of consumers said their financial services institution, 30 percent trusted secure payment sites such as PayPal, seven percent trusted their retailers and six percent, their mobile/internet service providers (ISPs).

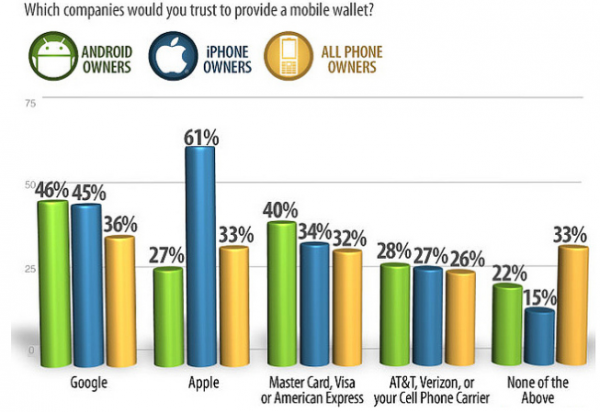

Electronics site Retrevo found somewhat different results in a survey of its users. Credit card companies and carriers were less trusted than Apple or Google to provide mobile wallet functionality.

Source: Retrevo (Q4, 2011)

Related Entries

- Verizon Blocks Google Wallet, AT&T Likely To Do The Same

- Google Checkout Is Dead, Long Live Google Wallet

- Google Wallet Surprisingly Easy To Use

- Google Wallet Now Live, But In Very Limited Availability

- Google Offers Go Live In SF, NY & On Upgraded “Shopper” App

- With Google Wallet Mobile Payments Era Is Finally Here

- PayPal Sues Google, Sees Powerful Threat To Its Future In Google Wallet

- First Impressions: Galaxy Nexus Android 4.0 Smartphone

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories