Android Closing Gap In Mobile Ad Revenue, Up 3 Percent In Q3 To 41.8 Pct. [Report]

Opera Mediaworks released its 2014 State of Mobile Advertising report today. The report encompasses 90 percent of the top Ad Age global advertisers that run mobile campaigns on the platform — reaching over 800 million unique users across 17,500 plus publisher sites and apps. The company saw mobile video ad use ramp aggressively and Android […]

Opera Mediaworks released its 2014 State of Mobile Advertising report today. The report encompasses 90 percent of the top Ad Age global advertisers that run mobile campaigns on the platform — reaching over 800 million unique users across 17,500 plus publisher sites and apps. The company saw mobile video ad use ramp aggressively and Android keeps gaining ground.

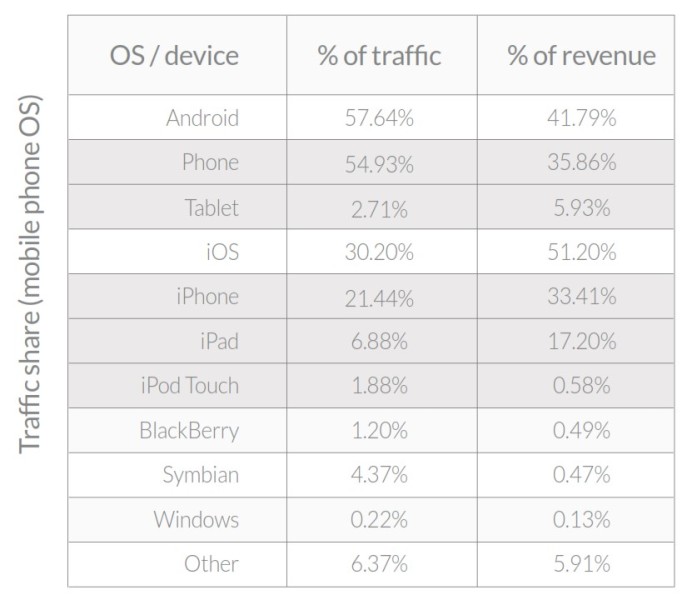

Android continues to gain in the market, capturing 57.6 percent of traffic share versus 30.2 percent for iOS. Android is also starting to close the revenue gap with 41.8 percent of revenue, a gain of 3 percent from the previous quarter. Apple’s iOS still holds the lead with 51.2 percent share of revenue.

Source: Opera Mediaworks

Phones on both OS leaders dominate both traffic and revenue compared to tablets. This is particularly true on Android.

Opera Mediaworks saw adoption rates of iOS 8, released in Q3 2014, were slower than last year’s release of iOS 7. A week after its release, iOS 8 accounted for just 28.55 percent of impressions compared to 64.93 percent of impressions gained by iOS 7 the week after its release in September 2013.

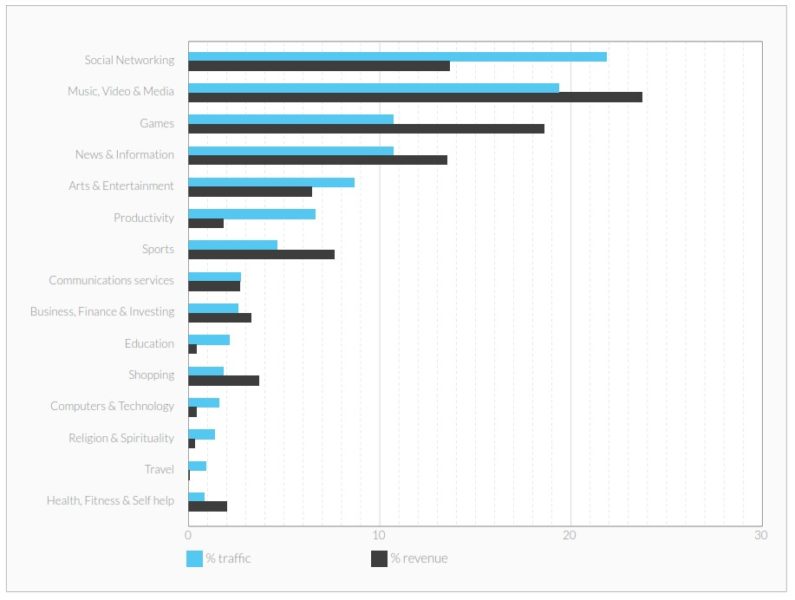

Social Networks Dominate Impressions But Music, Video And Media Rule Mobile Revenue

Social networking sites and apps continued to lead mobile impression share in Q3 2014 with 21.8 percent of impressions. Music, Video and Media sites and apps also keeps their hold on revenue generation with 23.1 percent of mobile revenue going to publishers in that sector.

Source: Opera MediaWorks

Asia’s growth in mobile ads may have begun to slow after gains in Q2 2014 when it overtook Europe for the number 2 spot in generating mobile ad impressions. While ad impression share nearly doubled from last year, from 15.3 percent to 27.4 percent, revenue growth has been slower. In Q3 2014, Asia’s mobile ad revenue was 8.4 percent, up from 4.9 percent.

Europe held 17.3 percent mobile ad revenue share in Q3 2014, while the US continued to dominate in mobile revenue potential with 44 percent of global share.

Mexico and Argentina saw significant revenue gains last quarter. Mexico jumped from number 10 to 4 on Opera Mediaworks list of top 20 countries driving mobile ad revenue. Argentina entered the top 20 list at number 13 for the first time.

The Americas (excluding the US) now holds 10.3 percent of the revenue share.

Mobile Video Impressions Have More Than Tripled This Year

Mobile video ad impressions have increased 3.5 times in the first three quarters of 2014.

From the report:

In Q1 of this year, we reported that 11% of our global ad impressions were rich media – with 2.5% being video. At the close of this quarter, over 15% of our total global traffic is rich media, with 8.7%, more than half of all rich media, coming from video formats.

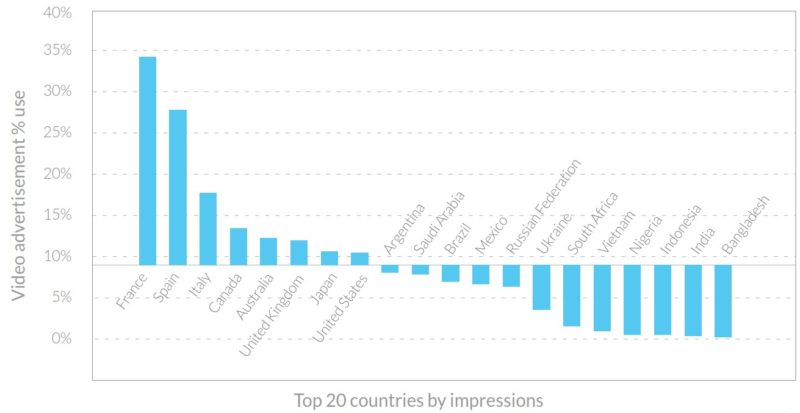

Because of device requirements and varied advertiser resources, Opera Mediaworks sees mobile video advertising usage is quite different from country to country.

Source: Opera Mediaworks

France leads in mobile video ad impressions – over 34 percent of the ad impressions Opera Mediaworks delivers there are in video format. In Spain 27.9 percent and in Italy 17.5 percent of mobile ad impressions come from video. The US, however is just slightly above the global average of 8.7 percent, with 10.5 percent of mobile ad impressions being video. That said, 1 in 10 mobile ads in the U.S. are now video.

Not surprisingly, entertainment leads in use of video mobile ad formats, with CPG companies and Financial Services firms coming in second and third, respectively among industry verticals. Electronics and retail are among the lowest adopters of mobile video advertising.

Publishers typically yield nearly 8 times the effective CPM (eCPM) of banners with video ads. Even in mature markets of Europe and North America, video eCPMs are twice as high as regular banner ads in these regions.

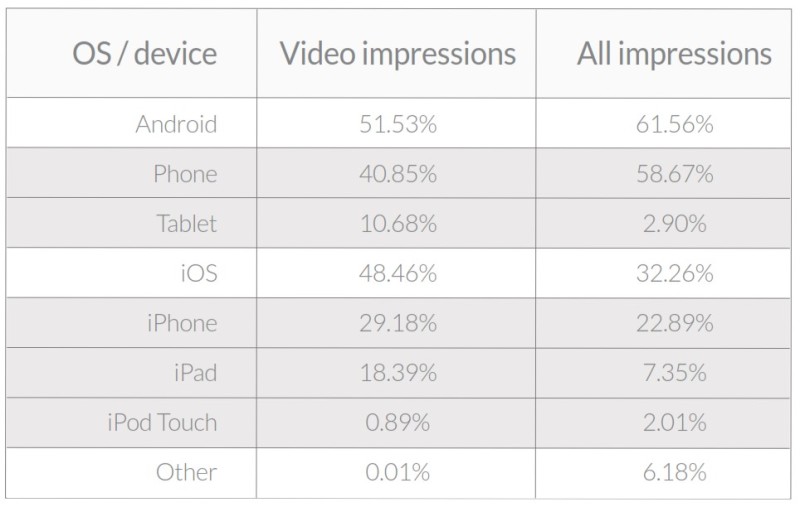

iOS And Tablets Video Ad Impressions Outpace Overall Impression Share

While iOS holds just 32 percent of smartphone ad impressions globally, the OS accounts for over 48 percent of video ad impressions. Similarly tablets, both Android and iPad, over account for video ad impressions compared to their overall impression share.

The full report can be found here.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories