Placed Brings Offline Attribution To More Programmatic Players

It’s well documented that more than 9 out of 10 retail conversions happen offline. That’s why measuring offline sales lift and store visits is becoming increasingly important, even critical, to brands and marketers. Only by capturing offline activity can marketers get a complete picture of how their digital media are performing. Offline visits and activity also yield new audience […]

It’s well documented that more than 9 out of 10 retail conversions happen offline. That’s why measuring offline sales lift and store visits is becoming increasingly important, even critical, to brands and marketers.

Only by capturing offline activity can marketers get a complete picture of how their digital media are performing. Offline visits and activity also yield new audience insights that can be factored back into targeting.

Google, for example, is placing more emphasis on store visits and offline analytics. Recently, mobile ad platform NinthDecimal and agency ZenithOptimedia announced a partnership to make offline visits a new measurement standard for clients. Before that Facebook introduced Conversion Lift Measurement, which tracks in-store sales impacted by online ads.

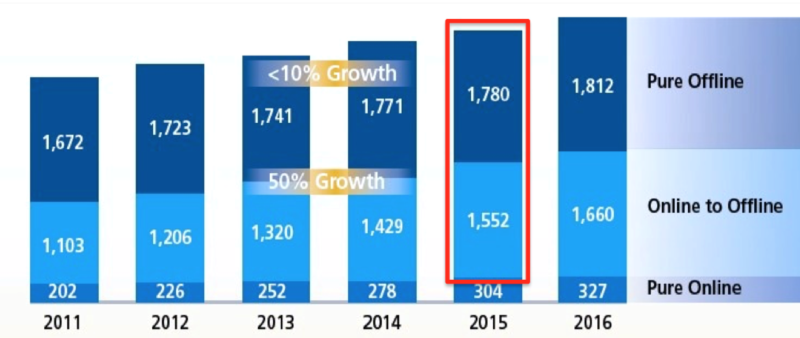

This is just a short list of examples of how offline/mobile data and ad exposures are being connected in the real world. Indeed, innovation in online-to-offline measurement is being driven by hunger for more complete campaign data, the desire to prove ad effectiveness and the recognition that digital-influenced in-store sales are growing quite a bit faster than pure ecommerce.

Source: Placed

Another massive trend is programmatic. Location analytics company Placed has brought offline measurement and programmatic together with the integration of offline store visits and attribution into programmatic media platforms.

Several new demand-side platforms joined a growing list of partners, networks, agencies and publishers that use its location panel for offline measurement and behavioral insights. Partners include DataXu, RUN, The Trade Desk, Adelphic, StrikeAd, Drawbridge, TapJoy, Vistar Media, xAd, Pandora and others.

The company has a large smartphone user panel that it taps for location and ad-performance insights and data. Placed recruits users with its own opt-in, incentive based app. But it also receives user-location data from more than 70 partner consumer-facing apps.

Beyond tracking ad exposures to store visits — others are able to do this as well — Placed is able to deliver audience insights and competitive intelligence by collecting user-location data (all opt-in). Users can be segmented into buckets based on offline activity and shopping behaviors.

This is offline location as real-world cookie

The company can also do things like report which Target consumers also shop and Wal-Mart or Kohls or whether Taco Bell is really competing with Chipotle or McDonald’s. Placed can also rank companies by share of foot traffic in a given market. These insights have obvious implications for ad targeting, retargeting and media planning.

Until very recently none of these data were available. Marketers had various ways they could model offline conversions or they could use coupons or proxy metrics like map lookups. However with Placed (and others such as PlaceIQ) marketers now gain actual insights into the offline impact and effectiveness of their campaigns — where the large majority of sales are likely taking place.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories