Fireside Musings: The Growth Of Real-Time Bidding

Today I’m sitting down to meditate on some of the reasons why programmatic ad buying — real-time bidding (RTB), in particular — has been showing such strong and steady growth over the past few years, and why industry analysts are predicting continued growth over the next several years. Much of the growth behind RTB has […]

Much of the growth behind RTB has been from two specific areas: mobile and video. So, that’s where I will focus my attention today.

There seems to be a lot of talk that RTB will ultimately make the biggest difference in mobile.

Question: Is this true? If so, why? What kind of impact will it have? How will it revolutionize mobile advertising?

Mobile has a bit of a supply and demand challenge at the moment. There is an abundance of inventory, without the matching “premium” demand, especially from larger brand advertisers that haven’t fully adapted to the mobile format. It’s hard to blame them, though; with the large amount of device fragmentation, it can be hard to create an experience to accommodate all the various models and screen sizes.

On the creative side, richer, brand-friendly ad units are being introduced to improve the impact of mobile ad campaigns, so there’s hope. There is also the emergence of native ads offered by the likes of Twitter and Facebook that give advertisers a more effective ad format, which also happens to be available in the RTB marketplace.

On the targeting side, there have been challenges in terms of behavioral targeting, mainly because mobile environments are not the most friendly to cookies. The solution is first-party targeting data provided by app publishers, but such efforts are fragmented and non-standard. Once this hurdle is overcome, it will be much easier for advertisers to define “premium” mobile inventory and audiences.

There is hope on the horizon, however, with large platforms like Twitter (which sits on mountains of behavioral and psychographic data spanning across multiple devices) acquiring supply-side RTB platform MoPub. Such a move allows them to leverage their native data across a vast amount of mobile inventory, with the potential to layer on hyper-local location targeting, all in real time, and all without cookies.

From a demand-side perspective, the aggregate demand that is represented by the RTB ecosystem undoubtedly helps mobile publishers achieve higher CPMs than through traditional ad networks, especially as programmatic adoption grows.

Question: How does the mobility aspect of mobile devices, location-based data and the like, stand to impact the performance of RTB on mobile devices and subsequent campaign optimization?

Mobile is pretty much the only hardware platform at the moment which allows precise location-based targeting, made available by location-aware apps. In the near future, that will expand to wearable computing and modern transportation.

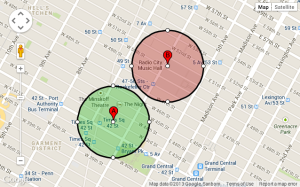

This form of hyper-local targeting will naturally usher in a new dimension of location reporting: by area or zone (as defined by GPS coordinates and specific radius). Reporting by zone will be an important factor for optimization, allowing advertisers to fine-tune campaigns beyond just the city level, but down to specific neighborhoods, districts, even intersections.

Question: What kind of impact is RTB having with online video advertising, and how is it helping online video advertisers better serve advertising?

RTB adds efficiency to almost everything it touches. It began with traditional display advertising on the web, and then it impacted mobile in a very large way, and now it’s evident from industry reports that video ad dollars transacted through RTB are growing at a very steady rate.

I think advertisers are wise to the power that RTB has brought to traditional display inventory and recently mobile, and prefer to conduct their video ad buys in a similar fashion. Without RTB, you not only lose the efficiency of buying in real time, but it also becomes impossible to layer on behavioral data to campaigns with the same reach.

Question: How is video RTB making online video campaign optimization and targeting more efficient and effective?

The RTB ecosystem operates based on a set of standards known as OpenRTB, which means that there is a predictability in terms of what information a buy-side platform has to work with. This means that DSPs can normalize campaign reporting to large degree across multiple campaign types: web, mobile, video, social, and so on. With a standard, normalized data set, advertisers have a solid foundation for their optimization efforts, and an efficient platform for gathering cross-channel campaign insights.

In terms of targeting, RTB brings the same effectiveness that it does to other channels: real-time decision making with the ability to layer on behavioral data. This means that advertisers can now run retargeting campaigns with video ads, combining the high ROI and spend efficiency of retargeting, with the high impact of video ad units, and the massive scale of the RTB marketplace.

Question to readers: Aside from mobile and video, what other reasons do you think account for the growth of RTB and programmatic ad buying in general?

Please leave your thoughts in the comments.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories