177 Car Maker Sites Vied For Ad Supremacy On Google In Jan & Feb, Driving 14 Million Clicks To Their Sites

Paid search is attractive to luxury and economy car manufacturers alike. Jaguarusa.com and Scion.com were among the 177 automotive manufacturer sites that competed for visibility on Google with paid search ads in January and February. The ads drove 14.4 million clicks — and that’s just on desktops and tablets. The new analysis from search marketing […]

Paid search is attractive to luxury and economy car manufacturers alike. Jaguarusa.com and Scion.com were among the 177 automotive manufacturer sites that competed for visibility on Google with paid search ads in January and February. The ads drove 14.4 million clicks — and that’s just on desktops and tablets. The new analysis from search marketing intelligence Adgooroo shows similar levels of competition among car makers on mobile devices.

If the pie chart below looks like a data-presentation-gone-wrong mess, that’s the point. Adgooroo’s chart underscores the fragmented reality of the highly competitive automotive space on Google AdWords. What’s amazing is that “Other” category accounts for 149 advertisers, or about 84 percent of the field. They grabbed about the same impression share as Chevrolet.com did alone.

Toyota, with its two sites Toyota.com and Buytoyota.com, won the impression battle, with Ford.com, Chevrolet.com and Honda.com rounding out the leaders.

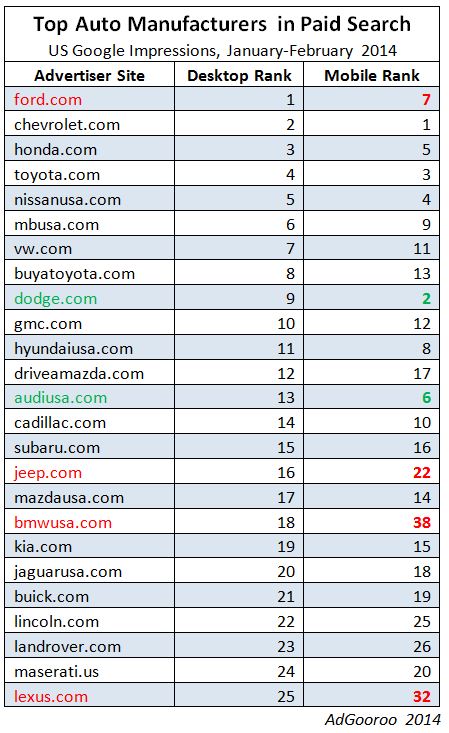

More advertisers are turning to mobile ads on Google to reach users searching on their phones to showroom and price compare. Dodge.com and Audiusa.com stand out for their relatively high rank among the other sites on mobile compared to their ranking on desktop. Dodge.com comes in at number nine on desktop, but rises to the number two spot on mobile. Audiusa.com isn’t in the top ten at 13 on desktop, but breaks in at number six on mobile.

Adgooroo provided Marketing Land with historical trends for the automotive manufacturer segment on Google paid search. Here’s the annual breakdown for desktop/tablet spend on Google in the U.S.

- 2010 $115 million

- 2011 $165 million

- 2012 $195 million

- 2013 $178 million

The drop in 2013 is likely attributable to advertisers reallocating budget to mobile, an Adgooroo representative told me by email, writing:

Although spend dropped between 2012 and 2013, we believe that dip is attributable to a shift in spend from Desktop/Tablet to Mobile Search. We do not have Mobile Search spend for 2013 because we debuted our mobile search product in 2014. However, our data shows that Mobile Search spend in January and February this year was at least $1.3 million and probably higher. Averaging the total for January and February ($1.3 million) over a full year, for instance, would add approximately $7.8 million to the Desktop/Tablet total, without even considering seasonality.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories

New on MarTech