Why Won’t Google Talk About Mobile Like Everyone Else?

Google has remained relatively cryptic in the way it discusses mobile advertising performance, and unlike its competitors, has refused to break out mobile ad results.

No secret here: Digital ad-driven companies that rose up in the world when desktops ruled have been forced to re-orient themselves while fending off (or scooping up) the nimble competition springing up from the “mobile first” ethos.

Some have managed the shift and articulated the mobile impact on their businesses better than others. But, no other company has made an art of talking-not-talking about mobile like Google.

For 13 straight quarters, Google’s aggregate average cost-per-click has been declining year-over-year. For 13 straight quarters, analysts ask about mobile and the impact it’s having on Google’s advertising business. For 13 quarters, Google has given increasingly oblique (and at times borderline obfuscated) responses to those questions.

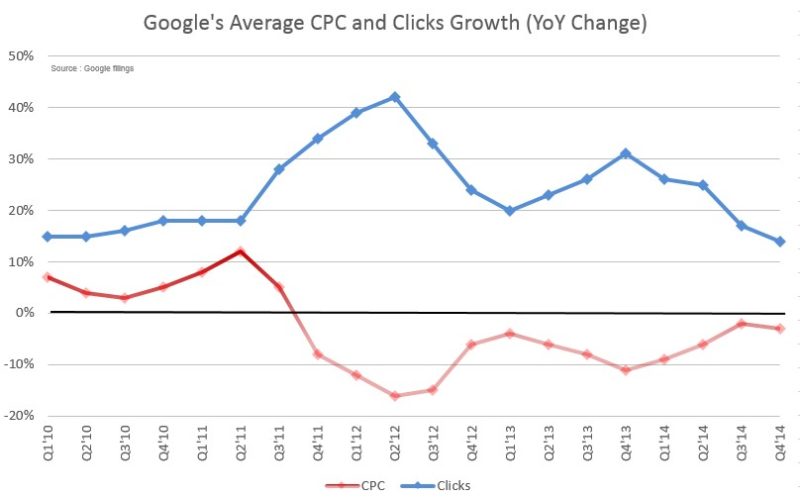

Since Q3 of 2011, aggregated clicks and average CPC growth have mirrored each other: when year-over-year click volume growth has gone up average CPC has fallen. The past four quarters have seen slowing click volume growth. Average CPC declines have lessened in that time, but they have continued to be off year-over-year.

Against The Tide: Google Refuses To Report On Mobile Ad Performance

I’ve already discussed why the aggregate CPC numbers Google reports can’t tell us if Google has a problem getting advertisers to pay for mobile clicks. Most analysts also understand that this number can’t be looked at independent of other metrics. But unlike nearly every other public company in the business of selling ads online, Google has yet to report on mobile ad revenues separately or give a satisfying explanation of what is happening with its mobile advertising business beyond we’re-happy-with-our-progress sorts of optimistic generalizations.

Facebook now reports on mobile. As does Twitter and as of last year, Yahoo. Google, instead began breaking out click and CPC performance by Google Sites and Google Network in the second quarter of 2014. The fact that Google stubbornly refuses to show mobile results — particularly in light of Facebook’s meteoric growth in mobile — begins to look as though it protests too much.

We Do Not Believe Telling Investors About Handset Revenue Is Meaningful

In 2013, the SEC asked Google if the 6 percent drop in average CPCs that the company reported in Q4 2012 was primarily attributable to mobile advertising.

First, with its Q4 2012 earnings, Google listed several factors and specifically mentioned lower mobile CPCs as a cause for the decline:

“The decrease in the average cost-per-click paid by our advertisers was driven by various factors . . . the changes in platform mix due to traffic growth in mobile devices, where the average cost-per-click is typically lower compared to desktop computers and tablets”

Yet, in its response to the SEC’s questioning Google said:

“Neither the decline in CPCs nor the increase in paid clicks were ‘primarily attributable to mobile’ in Q412.”

Maybe mobile wasn’t the primary cause for the decline, but instead Google blamed the increase on all the other factors it typically lists and left out the “traffic growth in mobile devices” mentioned in its earnings statement as a factor:

“While we do not believe that telling investors about a sub-category of multi-device ad revenue (i.e., handset revenue) is meaningful, we do believe that the eventual disclosure of revenues generated from digital content/apps, and/or hardware will likely be meaningful, when they reach material levels.”

How We Define Mobile Changes, So Reporting Will Be Too Confusing

Even after stating that revenues from apps or hardware will someday be meaningful to report, but mobile won’t, Google goes on to say that defining mobile is too hard:

“It is increasingly challenging to define what exactly a ‘mobile’ platform is from period to period — and what it will be going forward. For example, initially, most industry observers would have included tablets (in addition to handsets) in their definition of ‘mobile’.”

It’s true, Google was perhaps the first and still one of the few whose definition of mobile no longer includes tablets. Still, this is not a complicated concept for advertisers, investors, analysts, the SEC or my seven year-old to grasp. In the end, Google told the SEC that reporting on mobile clicks and CPCs would be too confusing.

Mobile As Behavior, Not A Device

When asked on the latest earnings call, if there was any sign that pricing per ad unit was starting to close from a device mix, Google’s interim Chief Business Officer Omid Kordestani, repeated something he’d said in his prepared remarks, “We look at mobile as a behavior, versus a specific device.”

Yes, I understand the essence of this viewpoint, but Google does look at mobile as a specific device: a smartphone. They established that with Enhanced Campaigns when they bundled tablet traffic with desktop. It’s also not a unique vision that mobile comes with its own set of behaviors. But this line of reasoning speaks to how we talk about and approach marketing, advertising and measurement on smartphones. It does not speak to why a company can’t report on mobile performance.

From Mobile To Multi-Screen

With the ushering in of Enhanced Campaigns, Google stopped talking about mobile and started talking about multiple screens in a constantly connected world.

For several years, Google’s annual 10-K filing had a “Google Mobile” section. Here’s how that paragraph read in its final year, 2012:

Google Mobile. Mobile advertising is still in early innings, though the mobile device is quickly becoming the world’s newest gateway to information. Google is focused on developing easy-to-use ad products to help advertisers extend their reach, help create revenue opportunities for our publisher partners, and deliver relevant and useful ads to users on the go.

In 2013, the company took out the Google Mobile section and added this statement:

As consumers increasingly live their lives across multiple screens, we introduced enhanced campaigns in AdWords to help advertisers big and small create relevant campaigns across all devices more easily. All of the more than one million AdWords advertisers are now using this new system, and the feedback we have gotten from marketers has been very positive.

The Evolution Of Google-Speak On Mobile

I went back through many of the earnings call transcripts to see how (or if) the way Google executives talk about mobile has changed. I’ve excerpted and bolded portions of what I think are noteworthy statements from some of the quarters since Q4 2011 when the first average CPC drop and separation from growth in clicks occurred.

Q4 2011

Here we see the coupling of clicks and CPCs. This quarter, click growth skyrocketed as CPC growth went negative. Google CFO Patrick Pichette also called out the aggregation of Google and AdSense/Network properties in these numbers:

“Remember, too, that this is an aggregate number which includes both Google.com and or AdSense properties. On this it is important to look at CPCs and clicks together. There are numbers of factors that affect each.”

Then in response to a CPC question, Susan Wojcicki, then SVP of Advertising & Commerce (now CEO of YouTube), mentioned sitelinks as a concrete example and explanation for the CPC decline as part of the mix of influences. Mobile gets mentioned in passing. (This is the most transparent response to the many questions to come on CPCs that I came across in the transcripts.)

“When we make ad quality and format changes, CPC and clicks may be impacted differently. For example, when we introduced sitelinks, we saw an increase in clicks, but the additional clicks were on lower CPC ads, which reduced the average CPC. Many of the ad quality changes in Q3 increased paid clicks and lowered CPCs, and they were revenue positive with good user and good advertiser metrics. . . . Another key driver of lower CPC growth was foreign exchange, and lastly there are mixed effects with mobile and emerging markets.”

Q2 2012

Aggregate CPCs saw their biggest drop year-over-year at 16 percent this quarter. This is one (and looks to be the only) time CPCs are blamed on unfavorable foreign currency exchanges (i.e., headwinds).

“And please remember that the currency headwinds also obviously had quite a negative impact on CPCs in Q2,” said Pichette.

Nikesh Arora, then Chief Business Officer, called out growing mobile site adoption among advertisers:

“In less than one year, the number of AdWords advertisers with mobile sites has doubled.”

When asked if mobile was cannibalizing desktop search, Wojcicki answered:

“We’ve spent a lot of time looking to try to understand how those two different types of devices and how those searches interact with each other. . . all of this is very complicated . . . I will say we believe that mobile searches are mostly incremental, for example on weekends, when users are out and about, we usually see a rise in mobile activity. And when users come back on Monday, we see a rise in desktop.”

Arora, when asked what they are doing about mobile CPC trends, responded:

“Well, I think the good news is we’re seeing phenomenal growth in the mobile queries across the board, whether it’s tablets, whether it’s mobile phones, whether it’s geographical . . . I think as a I said, mobile is right now where search was in 1999. . . . So, we are seeing mobile CPCs are healthy and we expect them in the long-term they will continue to be healthy and follow this trajectory that search has followed: more inventory, more effectiveness, more ROI for the advertisers, better pricing in the market.”

Arora in answering yet another question about CPCs:

“I already said that in my prepared remarks that we have over 1 million advertisers working with us in mobile advertising and we have over 300,000 mobile apps, so I think it’s a substantial number in terms of the number of advertisers that are involved in the mobile space. And I think, usually people get involved in the mobile space don’t distinguish between smartphones and tablets, they want to find the most effective ROI they can get and they want to capture as many queries as they can get on either device.”

Q3 2013

Enhanced Campaigns rolled to all advertisers in July 2013. Starting with this quarter, Pichette repeats this statement in his prepared remarks when announcing CPC declines on earnings calls. He stresses the various factors that affect cost-per-click, likely as a way to head off analyst questions about mobile and CPCs. (It hasn’t worked.)

“And we should note that currency fluctuations have had a real minimal impact on Q3 cost-per-click. Once again, I wish to remind everyone that our monetization metrics continue to be impacted by a whole set of factors, discussed on previous calls, they include geographic mix, channel mix, property mix as well as product and policy changes.”

Q4 2013

This is the first full quarter under Enhanced Campaigns. You’ll notice the change in clarity in the responses to questions about CPCs and mobile.

An analyst asked what it would look like if they plotted the evolution of CPCs across the top five geographies for search. Pinchette answered:

“Clearly there is a shift between all those platforms, whether it be mobile, tablet and desktop again across the world, so you can infer that as well. Our sites versus network. The U.S. is a strong network area, everybody knows that and so, you can basically kind of from your own inference kind of pick apart these kind of elements, but they together move to actually really make the ecosystem vibrant and growing. And at the end of the day what you have to, just how did you say it? ROI’s don’t lie, Nikesh? So, I mean at the end of the day that’s what you’re pleased about. You’re pleased about great results for our users that get them exactly the right answer they’re looking for and great answers for advertisers. So, that’s how actually you should think about it.”

Arora, when asked if Enhanced Campaigns could have an increasing positive impact going forward, or if the full impact is reflected in the fourth-quarter results, said:

“I think the way to think about it is that if you haven’t done something like this, our lives should have been extremely complex and you might have seen us de-accelerate because we would have get — gotten sort of tripped up in our own floating. And we wouldn’t want to do that because we’d have to explain why one screen works better than the other screen, how is the ROI from one compared to the other. And you create an artificial differentiation or distinction which doesn’t need to exist because at the end it’s about users, advertisers and publishers.”

Arora was then asked about the trend of users spending most of their mobile time in apps and “how do you envision Google potentially controlling a purchase funnel if we stay in apps all day like you controlled it in the PC era?” Pichette responded:

Let me jump in just sort of at a very high level . . . I think that the fundamental tenant is rather than to speak about mobile and only mobile. It’s really living with the user. And once you think through living with the user, supporting our users across all their day, whether it would be on a TV, whether it would be on a mobile phone, whether it would be on the desktop, whether it would be on with Google Glass wearables, that’s really the aim that we’re actually shooting for.

But when you’re looking for the question, the answer and actually getting you to the real assist across your day, not then just what the devices you’re on, what’s your question or what should we assist you. I think it’s the real question to answer and I think that’s a much broader and a much richer set of the opportunities for us rather than just to be cornered into one. So I kind of defend the premise of your argument, because I think it’s — I mean our agenda is so much richer and so much more exciting for us, when you think about it in the way we just did it. So that’s the way to think about it. Thanks for your question nonetheless.

Q4 2014

Pichette says continued strength in the company’s core advertising business “was really driven by a strong holiday and mobile performance from our Sites line. We saw a great momentum in our programmatic business highlighted by our mobile display and our ads platform product.”

Here’s Kordestani on performance advertising and the “mobile is now a behavior” statement :

“We continue to evolve the foundation of Google’s advertising business to reflect a multi-screen constantly connected world. Mobile is now a behavior, not a device, and it has a variety of unique characteristics.”

A UBS analyst gets to the heart of the issue and asks whether some of the pricing per ad unit is starting to close from the device mix — are mobile prices starting to get closer to desktop prices. Kordestani’s responded by repeating the mobile as behavior aphorism and went on to say:

“And we really think about the user and the context rather than a particular form factor or device. And similarly in terms of the pricing model here, what we are focused on really building this ecosystem just the way desktop took a long time to develop and have the right ad formats that really took advantage that the platform had to offer. . . . So unfortunately, I can disclose any specific breakdowns, but I can just say that we are very focus on all aspects of this just as we evolve to desktop we’re doing the same in this world.”

The Leader Holds Onto Legacy Disclosures Even As It Touts Its Mobile Capabilities

Is Google’s device-agnostic vision that advertisers should be prepared to meet users on whatever device is in front of them throughout their days wrong? No. But the question of whether Google is, in fact, meeting advertiser needs with their mobile ad formats, targeting and measurement tools is a valid one, because that’s where growth is going to come from. And that’s where the competition is coming from, both on the performance and brand fronts.

A good indication of whether Google is meeting advertiser needs, as Arora said back in Q2 2012, is “better pricing in the market”. At this point, investors have no way of knowing how Google’s mobile ad business is performing. They can just see overall click growth and revenue growth stalling coupled with ongoing CPC growth declines.

Why doesn’t Google tell the market what’s going on in its mobile ad business? Perhaps no good can come of it. A look at Google’s stock trend since the company first reported CPC declines in 2011 would indicate that the market’s questions about the health of its mobile business hasn’t kept investors away.

In the past year, the stock has fallen by as much as 19 percent from its peak last February. Yet, since releasing its Q4 earnings on January 29 and announced it missed revenue estimates again, the stock is up nearly 8 percent. Google continues to have investors’ trust that it will continue to innovate and grow, even if growth more closely resembles that of a blue-chip.

The market has hasn’t given Google reason to explain itself any further. It seems we can expect to hear more about how mobile is a behavior rather than a revenue driver that is achieving better pricing in the market.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories