How Users Of Various OSes Differ In Their Online Behavior Over Time

For marketers, timing is often as important as creative, the most obvious example being campaigns tied to particular holidays. These days, with complex analyses now possible for activities like email marketing, online promotions and blog posts, industry practitioners are actively pursuing the “best” timing for their latest initiatives. In this piece, we drill down into […]

For marketers, timing is often as important as creative, the most obvious example being campaigns tied to particular holidays. These days, with complex analyses now possible for activities like email marketing, online promotions and blog posts, industry practitioners are actively pursuing the “best” timing for their latest initiatives.

In this piece, we drill down into the nuances of this issue by examining the differences in hourly usage behavior between users of different operating systems and device types. These insights should hold particular value for those marketing to one or more definitive niches or who are looking to better segment their current activities based on the desired audience.

With each of the data sets outlined below, Chitika Insights analyzed a sample of tens of millions of device-specific online ad impressions within the Chitika Ad Network observed between February 26 and March 11, 2014.

Comparing Desktop User Bases

Mac and Windows users have traditionally been regarded as very different groups in terms of how and why they use their respective operating systems. However, hourly usage rates are one area where both sets of users, at least within North America, share a great degree of commonality.

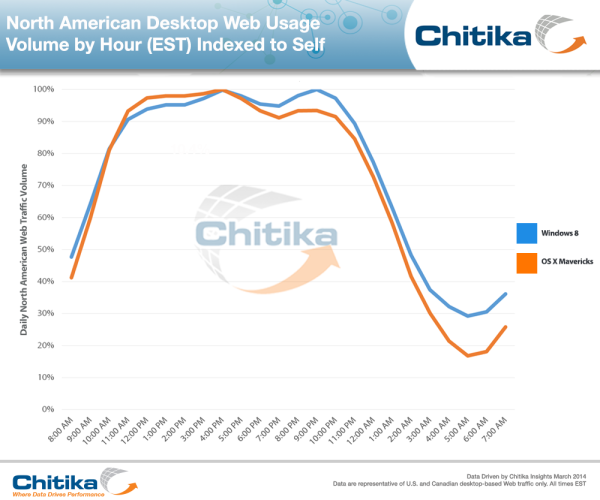

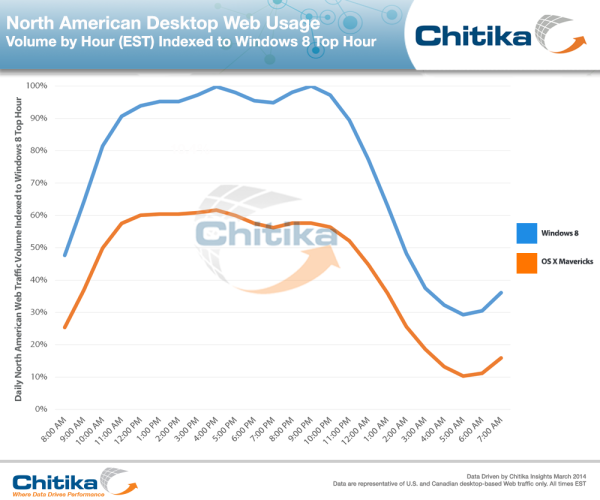

Below are two graphs which look at the issue from two separate angles. To provide some granularity, we specifically focused traffic generated by users of the two most recent operating systems from Microsoft (Windows 8 & 8.1) and Apple (OS X Mavericks).

The above chart displays daily usage patterns based upon the given maximum usage volume of each OS, essentially showing the usage patterns for both operating systems, all things being equal.

The following illustrates these patterns based on the highest usage volume observed overall, which in this case is from Windows 8.

Notice that both user bases exhibit their usage highs and lows at the same times with similar trajectories. The biggest difference is that OS X Mavericks usage experiences a slightly steeper dip during the early morning hours. Meanwhile, Windows 8 usage volume outstrips that of OS X Mavericks at all hours.

We can glean a couple insights from the data above. Though Windows 8 has received mixed reviews in general, users of the OS still generate far more traffic at all hours than those running Apple’s most recent offering. More importantly, in terms of target market segmentation for desktop audiences, while the content or messaging within a given campaign may change based upon targeting Mac or Windows users (e.g., computer games, accessories, services), the timing can largely be the same.

Both sets of users are most active during the workday, with usage volume dropping off in the late evening/early morning.

Comparing Mobile User Bases

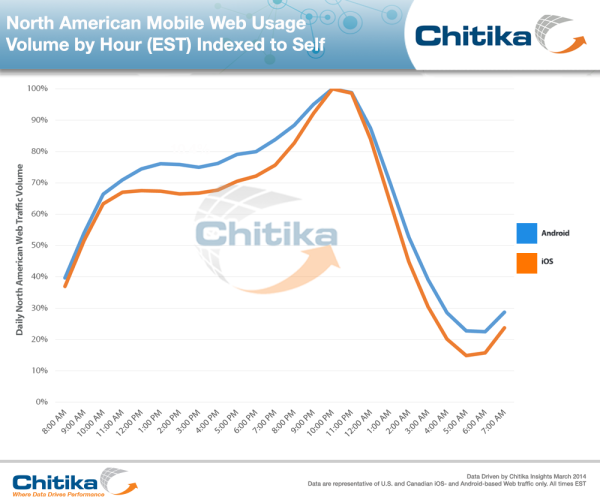

As seen below, North American Android users are more active than their iOS counterparts late at night and during the majority of the workday.

Yet, when viewed as a function of which OS commands the highest web traffic volume, iOS has a distinct, sizable advantage.

From 8 a.m. ET/5 a.m. PT until 1 a.m. ET/10 p.m. PT, cumulative browsing activity on iOS devices is more than twice the amount observed from Android devices. This difference is the largest during the peak traffic hour for both sets of users, 10 p.m. ET/7 p.m. PT, when total iOS Web traffic is 132% higher than that of Android.

Much of Apple’s advantage stems from its success in the tablet marketplace, where users of the company’s iPad collectively generate close to 80% of all tablet-based web traffic within the US and Canada. Even so, the differences in activity levels between the two user bases present some unique opportunities for marketers focused on either iOS or Android users.

In the case of Android, although total volume is dwarfed by iOS, its users are more consistently active throughout a given day, with the biggest advantage occurring during working and early evening hours. This means that marketers don’t necessarily need to time their campaigns for post-work leisure hours, when users are most active on their mobile devices, and instead can look earlier without sacrificing a great deal of their potential audience.

iOS users are consistently the most voracious consumers of mobile web traffic, but the higher degree of volatility throughout the day places more importance on those hours between 5 p.m. ET/2 p.m. PT and 1 a.m. ET/10 p.m. PT, when usage levels are between 70 and 100% of iOS’ peak traffic level.

When Timing Yields A Positive Impact

While these statistics can act as a general guide for planning the specifics around certain marketing campaigns, it’s important to know what constitutes timely content.

These include activities like email marketing or on-site promotions, each of which can benefit from a change in timing in terms of participation level. This is compared to so-called “evergreen” content, such as a thought-leadership blog post, which will hold value for hours, days or weeks at a time.

By understanding precisely where timing can yield a positive impact, marketers can use these statistics to their advantage.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories