Mobile Users: Consumers Are Buying, But Behavior Varies By Vertical

Mobile is hot and shows no sign of moving off marketers’ priority list. Not only is there an enormous, diverse mobile audience that includes tweens to great grandmas, but advertisers of all sizes are growing comfortable with mobile — because they are always on their own smartphones or tablets, as well. New research further validates […]

Mobile is hot and shows no sign of moving off marketers’ priority list. Not only is there an enormous, diverse mobile audience that includes tweens to great grandmas, but advertisers of all sizes are growing comfortable with mobile — because they are always on their own smartphones or tablets, as well. New research further validates mobile’s true purchasing power.

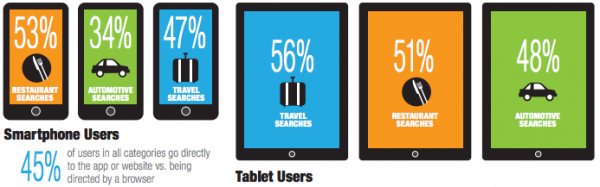

In June, we partnered with xAd, a leading mobile local ad network, to better understand specific mobile activities and behaviors across devices and within the Restaurant, Automotive and Travel vertical categories. The xAd-Telmetrics Mobile Path to Purchase Study included a Nielsen online survey of 1,500 smartphone and tablet users.

The results confirmed earlier supposition, leaving no room for doubt: mobile conversion is real, and local relevance and phone calls to businesses are important activities along the mobile consumer’s path to purchase.

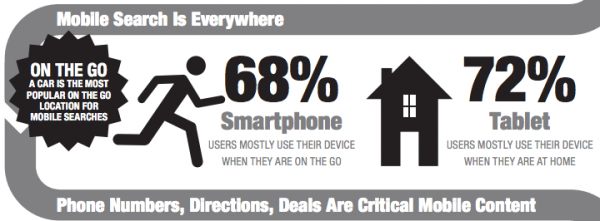

Overall, the findings showed that tablet owners mostly use their devices at home (over 72 percent), while smartphone users mostly use their devices “on the go” (over 68 percent); however, the top on-the-go location across smartphone and tablet users is the car. And not behind the wheel – oftentimes the navigator is searching while a spouse or friend drives, or a driver may be searching in a parking lot before heading to the next destination.

In the Travel category, behaviors on both smartphones and tablets were more research-focused. However in the Restaurants and Auto categories, smartphones were used more for looking up locations near the user and finding contact information, while tablet activities centered on research like viewing menu items and customer reviews.

The takeaway for mobile marketers and publishers is that mobile advertising campaigns cannot take a “one size fits all” approach, and advertisers need to better understand consumers’ mobile motivations and intent before deciding how and where to best engage them.

Also, mobile marketers should ensure their campaigns include phone numbers and other local contact information, as most consumers want to connect with the business before making a final purchase decision. Also, if an ad or listing doesn’t have local relevance at the time of action, the consumer will move on to the next business, so including local phone numbers — rather than toll-free numbers — is a good idea.

Mobile Conversion is Real; Immediacy Varies Among Verticals

While the Mobile Path to Purchase study shows that overall mobile purchase intent is strong, the amount of time that passes before consumers take action varies depending on the vertical market.

Mobile Restaurant searchers showed immediate transaction intent — 87 percent said they were looking to make a purchase decision within the day (as much as 64 percent within the hour). In Travel, however, only 33 percent said they were looking to complete their transaction within the day, as the nature of mobile Travel activities are more research based. Results for the Auto category were a mix of both quick conversions and research-based activity as 49 percent of searchers indicated an intent to complete the transaction the same day.

Regardless of timing, however, mobile activity still has a significant effect on consumers’ path to purchase. Eighty-five percent of mobile Restaurant searchers, 51 percent of mobile Auto searchers and 46 percent of mobile Travel searchers ultimately make a purchase. Also, the immediacy of the purchase need was consistent across both smartphones and tablets.

Local Information Critical

While consumers get a lot of business information on the go, according to the survey, they show a strong preference for information related to local contact — such as calling the business, looking up a business location and accessing map and driving directions.

Restaurant searches generate the most interest in calls – up to 73 percent of smartphone searches and 59 percent of tablet searches result in calls, while 50 percent of Auto and Travel searches generate calls. In addition, up to 84 percent of mobile searchers report looking up a business location and/or accessing map and driving directions.

Also, all reported mobile search activities show the growing usage of the mobile device as the “go-to” utility to find, contact and visit local businesses. Mobile users cited local relevance and local offers and promotions as the top reasons for engaging with mobile advertising — an important finding considering that 66 percent of mobile searchers noticed mobile ads and 33 percent clicked on an ad.

Mobile continues to dominate marketers’ focus, but recognizing that mobile consumers are unique – they search, connect and purchase so differently than in other media channels – is critical to tapping into this valuable audience.

To maximize mobile monetization opportunities, advertisers must develop mobile-specific strategies that consider the type of business and consumers’ likely mobile actions, as well as incorporate mobile users’ preference for local contact information.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories

New on MarTech