US market becoming a smartphone duopoly

Apple, Samsung dominate, while others are left behind.

Last week, Google received the largest antitrust fine ever imposed by the European Commission (EC). At the highest level, that fine is about Google’s dominance of the world’s smartphone market.

Android is far and away the dominant operating system, with a global market share of about 77 percent (or more). In the US, the iOS-Android split is less dramatic. While there is only one iOS smartphone maker, Apple, there are scores of Android device manufacturers around the world.

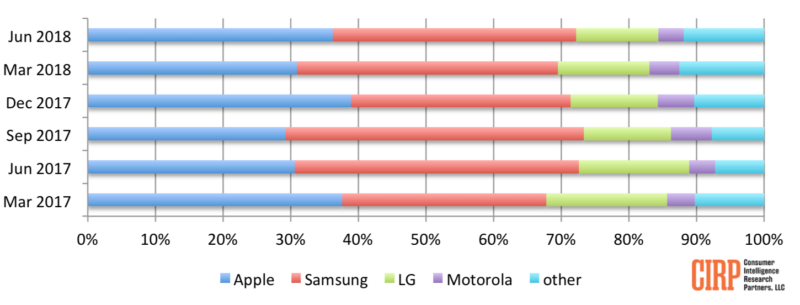

That diverse ecosystem has been instrumental to Android’s global success. However, in the US market, there is, increasingly, only one Android OEM that matters: Samsung. Consumer Intelligence Research Partners, LLC (CIRP) released new data showing that the US market is now essentially a duopoly.

CIRP says the US Android market is consolidating, with companies such as Motorola and LG losing ground to Samsung. Other Android makers have marginal single-digit share, without much chance of breaking through, according to the firm’s survey data and analysis.

Smartphone Activations

According to comScore, Samsung controls 30 percent of the US market. LG, Motorola and HTC combine for just under 15 percent. The iPhone has about 45 percent. The rest (about 10 percent) is miscellaneous Android and some remaining sliver of Windows phone users.

According to IDC, “other” is the largest category of Android OEMs globally, at roughly 37 percent. Samsung has about 19 percent, with Huawei in the global number two position at just under 11 percent share.

Much is at stake for Google parent Alphabet and Samsung depending on what happens in Europe. If the EC compels Google to decouple Google Play access from Google app pre-installation, it could shift the balance of power to big OEMs such as Samsung, who may decide to substitute different “default” apps or charge for position on the home screen.

If that were to happen, it could change the dynamics of the Android market. For example, if Samsung were to pre-install Bing as the default search engine, which is probably unlikely, that could significantly increase Bing’s mobile search market share. (Apple did this for Safari and reverted to Google ultimately.)

Speculating further, we might see acquisition of third party app stores and mobile ad networks by big Android OEMs, creating new OEM centric ecosystems within the larger Android universe (as in China). Depending on your point of view, that would either “diversify” or “fragment” channels for marketers to reach Android users.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories

New on MarTech