The Product Search Battle: Has Google Shopping Been More Successful Against Amazon Than Google Lets On?

A comparison of data sources offer insights into how close the competition for product search may really be between the two giants.

As the holiday shopping season heats up, the ongoing competition between Google and Amazon to be the destination for consumes researching products reaches its annual apex. Conventional wisdom holds that Amazon dominates in this realm. Recent data, however, suggests Google may be gaining ground or at least is not as far behind as Google has intimated.

Product search is worth billions, and the overhaul of Google Shopping into a paid platform in 2012 was designed to combat losses to Amazon. In that year, a 2012 Forrester survey found that 30 percent of searches started on Amazon and 9 percent originated on Google. The study concluded, “in recent years, [Amazon] appears to have taken market share from search engines like Google, the dominant incumbent in shopping research.”

Finding out just how well Google Shopping is performing in product search compared to Amazon is hard. Google doesn’t report on that portion of the business separately and various reporting outlets source data differently. Here I’ve pulled several sources for comparison.

By nearly all accounts, the revamped Google Shopping has been highly successful in attracting ad dollars from retailers. According to sources close to the business, Google Shopping now generates at least a $5 billion annually from more than 25 thousand advertisers.

It also may now be succeeding in drawing search volume from Amazon.

What Google Says

In Europe, Google has used Amazon as a shield against monopoly claims. If Google isn’t the leader in product search, for example, the EU can’t say it’s a monopoly.

In October 2014, during a speech in Berlin, Google’s executive chairman Eric Schmidt made a point of saying that in the prior year “almost a third of people looking to buy something started on Amazon — that’s more than twice the number who went straight to Google.”

Schmidt’s numbers reference 2013 performance, just a year into Google Shopping’s transition to a paid platform.

Google told Marketing Land it would not disclose internal numbers and it’s not clear what that data source was. Let’s look at more recent research from other sources to see if this split is likely to still hold.

Consumer Surveys Point To A Smaller Divide

A 2015 retail survey, again from Forrester, found that 13 percent of US online adults who did research before purchasing a product researched on Amazon. Still the highest of all 23 sources included in the survey question. Update: Forrester filtered the 2015 responses to included only those who purchased a product online to make a clearer comparison to the 2012 study for Marketing Land. Among that set, 27 percent started their product research on Amazon in 2015, down a bit from the 30 percent in 2012.

Another recent survey from BloomReach found that 44 percent of 2,000 US consumers polled said they start their product searches on Amazon, while 34 percent said they start on search engines like Google, Bing and Yahoo.

Neither survey points to Amazon receiving more than double the number of product searches started on Amazon as Google. The problem with surveys, however, is that they measure what people say they do. We know that what people say they do is often very different from actual behaviors.

Searcher Query Volumes Show Google Neck and Neck With Amazon

What happens when we look at search query volumes for products on Google and Amazon?

Marketing analytics firm, Jumpshot, tracks mobile and desktop search activity from a user panel of over 115 million consumers globally. It is able to see the search queries those consumers use on Google and Amazon and compare search volumes on specific keywords across both sites.

According to data Jumpshot shared with Marketing Land, searchers started 46 percent of product searches on Amazon and 54 percent on Google. The data is pulled from 26 product terms of the top 200 search terms on Amazon between July 1, 2015 and September 30, 2015 from a cohort of more than 120,000 users in the U.S.

In a year-over-year comparison, 39 percent of searchers went to Amazon, 61 percent went to Google. So Amazon gained share by this measure.

Same Store Sales Growth

What if we look at ecommerce performance from both channels? ChannelAdvisor tracks sales revenue generated by its ecommerce merchants on Amazon and Google Shopping.

ChannelAdvisor Executive Chairman Scot Wingo said, “Our data for October showed Google PLA/Shopping growing at 30 percent year over year and Amazon at 16.4 percent. So for October, Google grew faster than Amazon and effectively ‘took share’. Throughout 2015 they have been bouncing around, sometimes with Amazon ahead and other times Google PLA/Shopping ahead.”

Another factor to consider, says Wingo, “is that we are definitely seeing PLA’s take share from traditional AdWords. Adwords grew -7.4 percent year over year for October, to put it in perspective.”

Again, a mixed bag of results from both companies throughout the year, but very strong growth from Google Shopping in the past few months heading into the shopping season, while Amazon’s growth has slowed.

The SERP: Clicks From Google To Amazon

Of course, when users do search on Google, many of end up clicking on Amazon organic links or text ads. Google obviously benefits directly if those clicks go to ads. Amazon notably does not run Google Shopping campaigns.

Business intelligence software company, SimilarWeb, pulled data for Marketing Land showing the percentage of clicks that Amazon received from organic links and text ads on Google on a set of keywords over the past 6 months.

The percentages vary by keyword, but it is interesting to look at the SERPs for some of these queries from the Amazon perspective.

According to SimilarWeb, for the query “adult coloring book” 28 percent of clicks to Amazon came from a text ad; 72 percent were on an organic listing. In some cases, Amazon’s text ad at the top of the right colon, more often, as below, it showed up in a top of page spot above the organic listings, where it consistently held the top position. In this example, notice the product listing ads appear along the top of the results.

Then there’s a result like “backpacks”. SimilarWeb shows Amazon received 100 percent of clicks from organic links on this term. Amazon did not appear to be advertising on this broad category term at all, but maintained a prominent organic ranking.

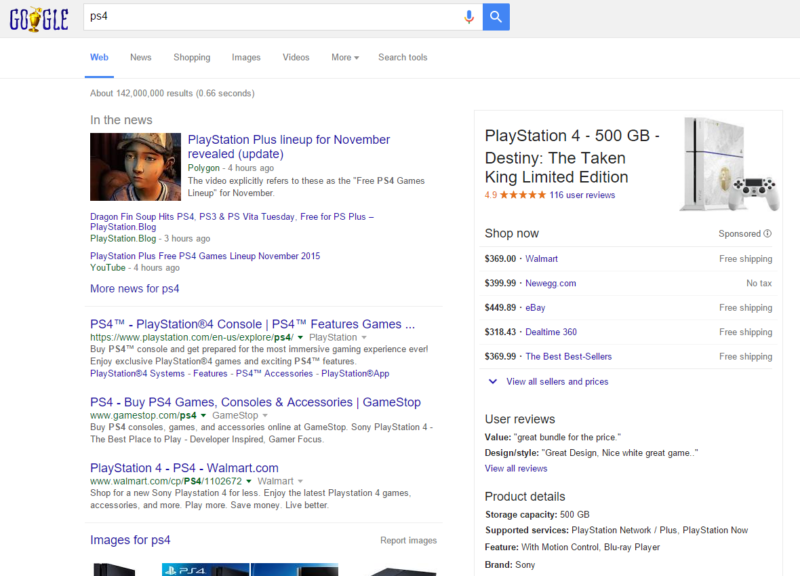

Here’s where things get interesting. Amazon got 100 percent of its traffic from for the query “ps4” from organic links,” according to SimilarWeb.

This SERP looks quite different from the two above. On the organic side, news and image results and even “People also ask” blocks break up the organic listings.

On the ads side, Google has been experimenting with variations on product cards in panels like the one below. Instead of multiple PLAs, retailers advertising on Google Shopping are listed in the product card. Amazon is excluded from showing up in this the list since it doesn’t participate in Google Shopping. When it does run a text ad on a SERP like this it appears well below the fold on desktop. On mobile, the product card takes up the entire screen.

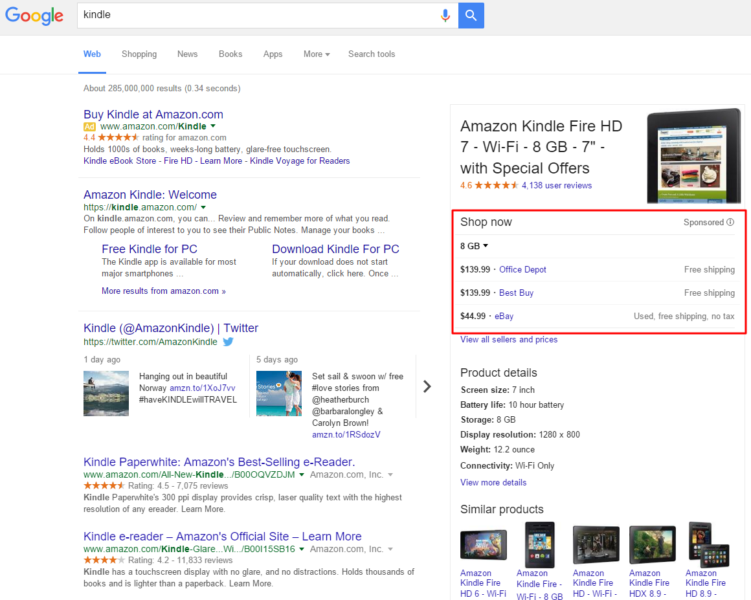

Google also sometimes shows a product card on the SERP for Amazon’s own “kindle”. Here Amazon’s text ad does appear in position one, but it has no visibility in that product card, which takes up most of of the right column and features a large product image to grab users’ attention.

Sure, the product cards offer a good user experience. But it’s hard not to also see Google’s product cards as, at least in part, a stab at Amazon’s SERP visibility. That said, Google has a walk a fine line — too many product SERPs without prominent Amazon listings and/or ads and it stands to lose credibility and users.

Plans to compete for the holidays

Coming into the holiday season, Google has released several new features for Google Shopping advertisers. Here are just a few:

- Shopping ads can now extend to YouTube videos.

- Advertisers can apply remarketing lists to PLAs and local inventory ads (LIAs).

- The new Shopping Insights tool shows what people are looking for online around store locations

- The Assortment Report shows which products are driving clicks in real-time.

- Text ads haven’t been forgotten. Ad extensions will start showing offers for Black Friday and Cyber Monday next week.

Though the results from these various sources are somewhat mixed, it’s clear that Google is aggressively going after the retail ad dollars and consumer product search. It also seems likely that Google is challenging Amazon more effectively than it’s willing to say publicly.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories

New on MarTech