Study Shows Price The Top Consideration For Kindle Fire, Android Tablet Owners

Measurement firm comScore is launching a new tracking and metrics program for tablets. To publicize the new service comScore released some initial data, “based on a 3-month rolling sample of 6,000 US tablet owners.” Treating Kindle Fire as a distinct category, comScore created demographic profiles of each segment of tablet owners. While iPad ownership skews […]

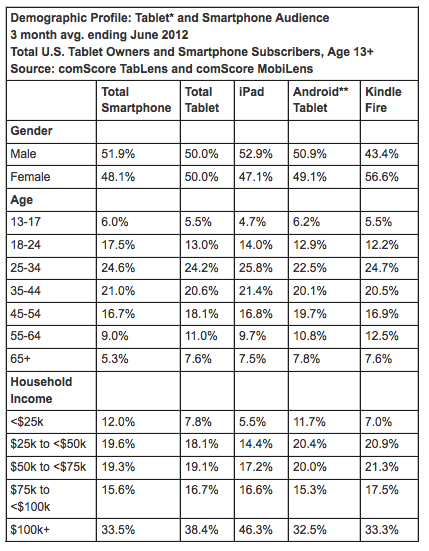

Treating Kindle Fire as a distinct category, comScore created demographic profiles of each segment of tablet owners. While iPad ownership skews slightly more male, comScore found that Kindle Fire ownership is more heavily female with general Android tablet ownership (pre-Nexus 7) evenly split.

Owners of the iPad were more affluent on average than owners of the other tablets. That makes sense in the case of Kindle Fire, which is cheaper. Its success has largely been due to aggressive pricing as well as the Kindle brand. But there are other Android tablets that were priced to match the iPad or in some instances exceeded its cost.

The iPad demographics in the table above are probably a spillover from iPhone demographics to a degree. Owners of the iPhone tend to be more affluent than Android owners as a crude generalization.

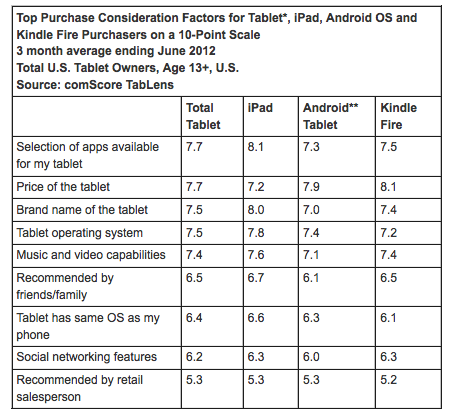

The data also show that different tablet shoppers have different considerations (apps, brand, price) in mind when choosing a device and those play out in purchase behavior — which makes sense. More price sensitive users tend to opt for cheaper tablets and so on.

Owners of the iPad placed the greatest importance on the selection of apps, followed by the tablet brand. Android and Kindle Fire owners placed the greatest emphasis on the price of the tablet. Interestingly comScore found that operating system wasn’t a “top five” consideration:

Consumers did not place strong importance on having the same operating system across their tablet and smartphone, with this factor falling outside of the top five consideration factors for iPad, Kindle Fire and the average tablet owner.

The company observes that this creates a potential opening for Microsoft: “This finding highlights the potential for brands, such as Microsoft with its recently announced Surface Tablet, to see consumer adoption in the tablet market even though they might lack strong penetration in the smartphone market.”

However it equally highlights the risk for Microsoft in terms of price. If Redmond prices the entry level Surface tablet too high it’s probably DOA.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories