Social Shorts: Twitter ad engagement drops, Snap Minis launch, more brands pause Facebook Ads

Twitter ad engagement suffers. Snapchat user gains slow We’re starting to get a clearer picture of how the pandemic affected social platforms last quarter. This week, even as monetizable daily active users increased by a whopping 34% to 186 million, Twitter reported ad revenue fell by 23% year-over-year to $562 million in Q2 (total revenue […]

Twitter ad engagement suffers. Snapchat user gains slow

We’re starting to get a clearer picture of how the pandemic affected social platforms last quarter. This week, even as monetizable daily active users increased by a whopping 34% to 186 million, Twitter reported ad revenue fell by 23% year-over-year to $562 million in Q2 (total revenue was $683 million, down 19% year-over-year), that’s coming off flat ad revenue growth in the first quarter of 2020. Twitter’s sharp decline in ad revenue was matched in a steep drop in ad engagement and cost per engagement.

Why we care. The trends of these two metrics, shown in the chart above, put in stark light the challenge Twitter’s ad business has been facing for many quarters now. Performance advertisers require engagement with their ads. Ned Segal, Twitter’s CFO, said in a statement that the company is still focusing on performance ads. “We have completed our ad server rebuild and are making progress accelerating our performance ads roadmap. With a larger audience and progress in ads, we are even better positioned to deliver for advertisers when the live events and product launches that bring many people and advertisers to Twitter return to our lives.” (The company is also looking at subscription options.)

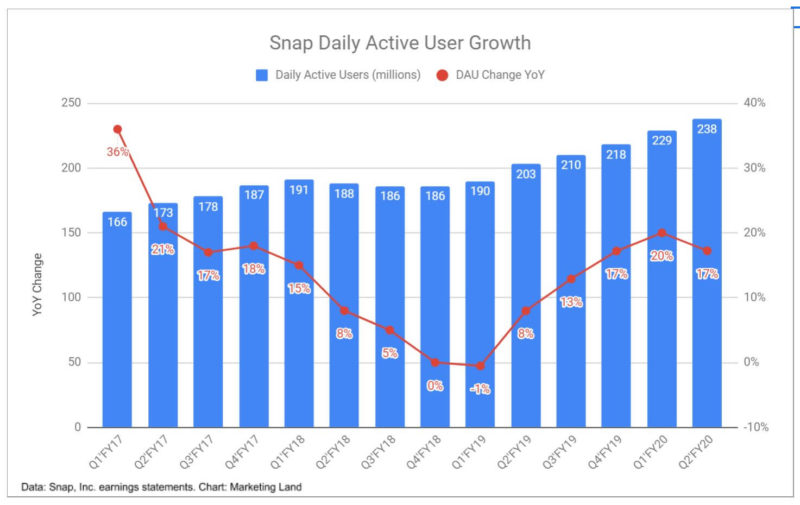

Earlier in the week, Snap reported revenues rose by 17% year-over-year to $454 million. Investors were disappointed the big bump in users that Snapchat saw at the beginning of shelter in place didn’t continue. Daily active users were up 17% to 238 million, just shy of the 239 million the company had been shooting for.

Why we care. Snap’s ad revenues were impacted by disruptions to industries such as transportation services, restaurants and entertainment venues, but Snap CEO Evan Spiegel said e-commerce, streaming and gaming advertisers are leaning into the platform. While Snapchat’s audience skews young, the company also noted that the daily average number of Snapchatters over the age of 35 engaging with Discover content increased by over 40% year-over-year in Q2 2020. The company also said it’s benefiting from Facebook’s brand safety troubles with more brands taking a fresh look at Snapchat.

Twitter strikes at conspiracy content

Twitter said it will take action against conspiracy theory-ridden QAnon content on its platform starting this week. It will permanently suspend accounts tweeting about the topics, block URLs associated with QAnon from being shared on Twitter, and content and accounts associated with QAnon will not serve in Trends and recommendations. Twitter took down 7,000 QAnon accounts and is limiting 150,000 others that flood the platform with abusive content and coordinated attempts to get hashtags trending, NBC News reported.

Why we care. Twitter’s action against misinformation and conspiracy theories is significant for a platform and stands in stark contrast to Facebook’s “we aren’t arbiters of truth” approach in the midst of an advertiser boycott over brand safety and content moderation concerns.

Facebook Ads boycott: More brands quietly sit out

Several large brands have quietly paused ads on Facebook. Disney pulled ads for Disney+, according to the Wall Street Journal, and Walmart, Geico, Allstate, Kellogg’s, Kohl’s, Dell, McDonald’s, Peloton and Ikea stopped advertising early in the month, per a new report from watchdog group Media Matters. Walmart was Facebook’s second-biggest spender in 2019 at more than $145 million, Media Matters estimates.

More than 1,000 advertisers such as Unilever, Starbucks, Adidas and Verizon signed onto the #StopHateForProfit campaign and agreed to stop advertising via Facebook Ads for the month of July over concerns about content moderation and policy enforcement around objectionable content.

Why we care. The financial dent of these big advertisers alone won’t cripple Facebook, which has millions of SMB advertisers facing their own challenges due to COVID-19. Nor is that the point. “It’s more for us to assess, as marketers and arbiters of our brands’ equity, whether we should continue defaulting to a platform that stands in opposition to consumer sentiment today,” Elijah Harris, senior vice president of paid social at IPG Mediabrands told Business Insider last month. Facebook published an update on its brand safety efforts. One step involves enlisting the Media Rating Council (MRC) to conduct an evaluation of its partner and content monetization policies and brand safety controls as well as the accuracy of Facebook’s related reporting.

Snap Minis start rolling out

Snapchat has released the first set of mini apps on the platform. The lightweight HTML apps “are designed to improve engagement among users by enabling them to perform a range of additional tasks without leaving the Snap app,” TechCrunch reported.

The initial apps are Headspace for mediation, Flashcards for studying with friends, Prediction Master for messaging and Let’s Do It, developed by Snap to allow users to make decisions with their friends.

Why we care. The mini apps are available within Snapchat’s Chat section and are part of a strategy to beef up engagement among the app’s 229 million daily users who represent roughly 90% of 13 to 24 year-olds in the U.S. More engagement means a more enticing environment for brands and advertisers. Last week, Snapchat debuted brand pages that give brands a home base, similar to other social networks.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Related stories

New on Search Engine Land