Snapchat added users, increased revenue in Q4, but ‘still extremely under-monetized,’ says Spiegel

The CEO says Snapchat is focused on attracting more advertisers to the platform.

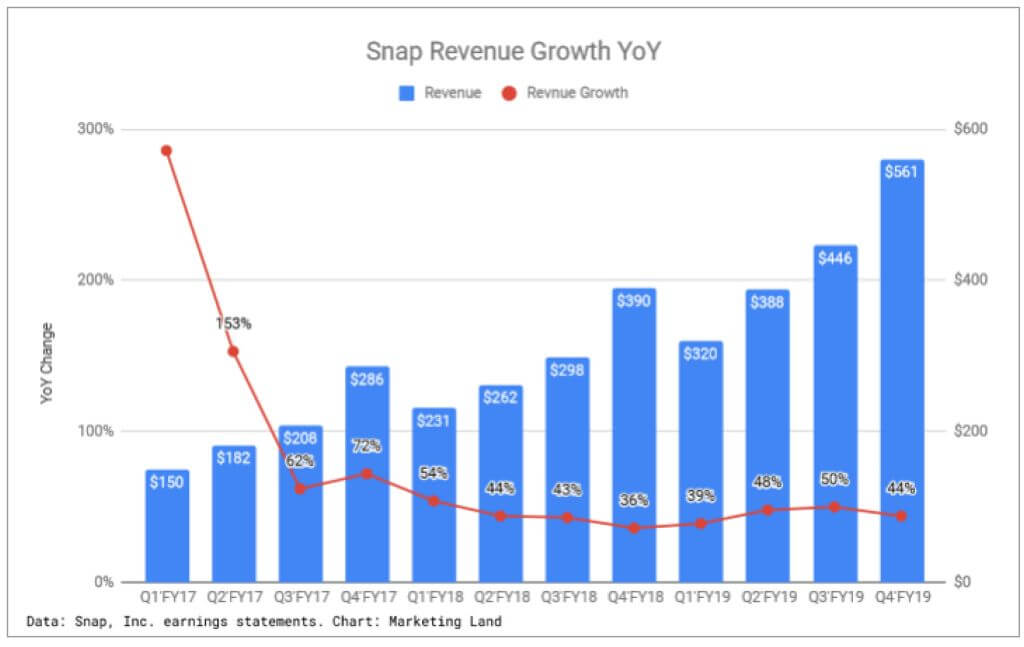

Snap Inc., the company behind Snapchat, reported a 44% year-over-year increase in revenue for the fourth quarter of 2019, reaching $561 million. Daily active users (DAUs) on Snapchat reached 218 million, up 4% from 210 million in the previous quarter.

Snap fell short of analysts’ revenue expectations of $563 million – a sign the company is still struggling to stand out among rivals like Instagram and now TikTok.

Steady growth in DAUs. Wth an increase of 17% compared to a year ago, DAUs rose by the biggest rate year-over-year in the fourth quarter of 2019 since the fourth quarter of 2017 when the daily audience grew by 18%. Total daily time spent by watching Snapchat’s Discover tab increased by 35% year-over-year in Q4 2019.

Slowing ARPU growth. The average revenue per user (ARPU) rose 23% to $2.58 year-over-year, but growth is slowing compared to the 33% growth from the previous quarter.

Story and Commercial ad highlights. While Snap doesn’t provide a breakdown of ad revenues, the company did indicate that revenue from its Commercials ad unit more than tripled year-over-year, and Story Ads doubled in the fourth quarter of 2019.

Why we care. Snap CEO Evan Spiegel reiterated this quarter that he sees Snapchat as “still extremely under-monetized” and believes there is a “significant opportunity” to scale revenue success across more advertisers. The company is focused on growing its total number of advertisers on the platform and diversifying its brand partners, said Snap’s chief business officer Jeremi Gorman.

In addition to investing in more camera/Lens tools and Discover page content, Snapchat said it’s focused on strengthening its ad offering with AR-driven features, more brand partnerships, and innovative new tools to help serve its “large and engaged community.”

While television and desktop budgets make up the majority ad spend in the U.S., Spiegel says advertisers are “increasingly unable to reach [Snapchat’s] unique demographic on those platforms.” If Snapchat’s “unique demographic” is the primary selling point for advertisers, it will face stiff competition from rival digital platforms that are also reaching younger audiences.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories