Samsung Taking Share From Other Android OEMs, Not iPhone

A “meta-analysis” of smartphone owner surveys, conducted between July 2012 and July of this year by research firm CIRP, produced some interesting findings about who buys Samsung (Android) smartphones and who buys the iPhone. There were a number of generalizations that emerged from the analysis: Samsung buyers are mostly prior Android and feature phone owners […]

There were a number of generalizations that emerged from the analysis:

- Samsung buyers are mostly prior Android and feature phone owners

- Apple owners mostly come from prior Apple ownership, with a smaller number coming from feature phones

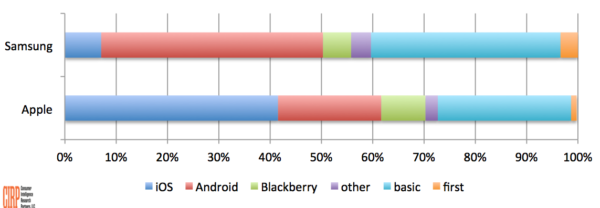

- 42 percent of Apple customers already had an iPhone, while 43 percent of Samsung customers owned Android handsets

All buyers’ previous operating system

CIRP found, however, that among all buyers “Apple takes a meaningful share of their new customers from Samsung’s installed base.” Roughly 20 percent of iPhone buyers come from Samsung phones vs. 7 percent of iPhone owners who “defect” to Samsung.

However, more first-time smartphone owners tend to upgrade to (or buy) Samsung smartphones vs. the iPhone.

The report also finds that both Apple and Samsung have high brand loyalty. But among people switching handsets/platforms, Apple takes more of Samsung’s (and Android’s) customers than the reverse.

In contrast, Samsung is taking customers and share from fellow Android OEMs (HTC, Motorola) as well as Nokia (Windows Phone). Apple captures a higher proportion of BlackBerry users switching devices.

Brand switching: previous handset OEM

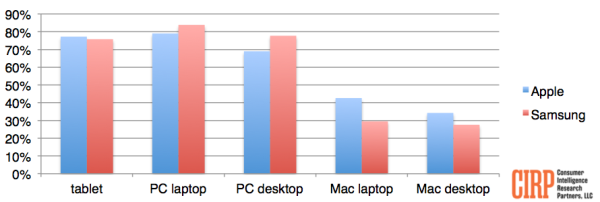

Depending on your perspective, it’s either a surprise or entirely predictable that iPhone buyers tend to have proportionally more Macs than PCs. The reverse is true for Samsung/Android users:

Apple buyers also have Mac computers more than Samsung smartphone buyers do. And, Samsung buyers have PCs more than Apple buyers do. Commensurate with each platform’s market share, about twice as many of either Apple or Samsung buyers have PCs as have Mac computers.

Other equipment owned by Samsung, Apple buyers

According to the survey review, Apple buyers are a slightly younger and more affluent than Samsung handset owners. They also tend to be somewhat better educated: “48 percent of Apple buyers have a college degree or higher, compared to 32 percent of Samsung buyers.”

It used to be though that the iPod Touch was the on-ramp or “gateway device” for younger people to the iPhone. However these data suggest that strategy isn’t working entirely.

It’s not clear from the analysis above whether price is the main factor in the tendency of first time smartphone owners to prefer Samsung/Android to the iPhone. But perhaps this concern is likely one of the considerations behind the forthcoming lower-cost iPhone “5C.”

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories