Microsoft Revs Beat ($23.2B) But It Sells Less Than 10M Phones

This afternoon Microsoft reported fiscal Q1 revenues and profit, beating Wall Street estimates for both the top and bottom lines. Quarterly gross revenues were $23.2 billion. Adjusted profit was $0.65 per share. The company’s “devices and consumer business” (Office home, Surface, Xbox, Phones) brought in $10.96 billion. Enterprise (“commercial”) revenue was $12.28 billion. Within those […]

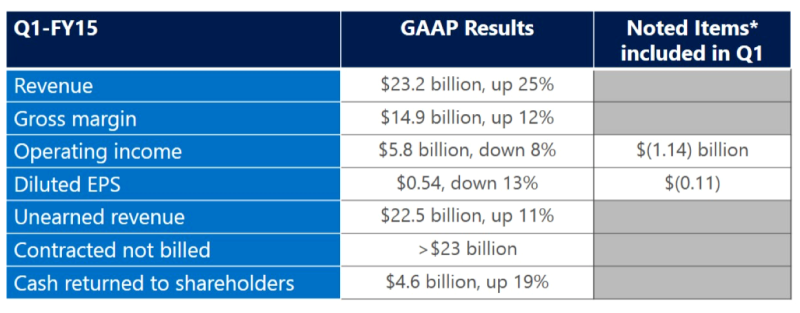

This afternoon Microsoft reported fiscal Q1 revenues and profit, beating Wall Street estimates for both the top and bottom lines. Quarterly gross revenues were $23.2 billion. Adjusted profit was $0.65 per share.

The company’s “devices and consumer business” (Office home, Surface, Xbox, Phones) brought in $10.96 billion. Enterprise (“commercial”) revenue was $12.28 billion. Within those results cloud revenues outperformed analyst estimates as well. Azure and Office 365 generated $2.4 billion (vs. $2.3 billion expected). Gaming revenues were also strong at $2.45 billion.

Devices were mixed, with Surface Pro 3 doing well and Windows Phones/Lumia devices selling fewer than 10 million units.

Other numbers and highlights:

- Office 365 Home and Personal subscribers: more than 7 million

- Surface revenues: $908 million

- Phone hardware revenue exceeded $2.6 billion

- Xbox sales: 2.4 million

Microsoft said it sold 9.3 Lumia smartphones in the quarter, compared to nearly 40 million iPhones sold the September quarter for Apple. Overall Windows Phone licensing revenues were also down 46 percent.

Microsoft appears to have a hit on its hands with Surface Pro 3 but its phones have not captured the public’s imagination except in isolated European markets, which have a strong affinity for the Nokia brand. However Microsoft is phasing out the Nokia brand, which will probably negatively impact future sales in those markets.

It’s not clear what can help the company gain share in the smartphone market, except aggressive price-cutting. That would destroy margins but potentially boost adoption.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories

New on MarTech