Google Quietly Testing Offline Store Visits Tracking

Last month Google announced a program called “Estimated Total Conversions.” That program is intended to report or provide visibility into cross-device and offline conversions by tracking the activities of signed-in Chrome users and extrapolating that data to the broader Google user population. The offline component of conversion tracking wasn’t supposed to begin until 2014. However, according […]

Last month Google announced a program called “Estimated Total Conversions.” That program is intended to report or provide visibility into cross-device and offline conversions by tracking the activities of signed-in Chrome users and extrapolating that data to the broader Google user population.

The offline component of conversion tracking wasn’t supposed to begin until 2014. However, according to a report in Digiday, Google is currently experimenting with tracking offline store visits, using smartphone location, and trying to connect that back to mobile ad exposures:

Google is beta-testing a program that uses smartphone location data to determine when consumers visit stores, according to agency executives briefed on the program by Google employees. Google then connects these store visits to Google searches conducted on smartphones in an attempt to prove that its mobile ads do, in fact, work.

Google is reportedly using location in the background (on Android and iOS) and its database of business locations (my guess) to determine when people visit stores. However Google is not the only company trying to connect mobile ad exposures to store visits. In fact Google is late to the party.

As I’ve previously written several other ad networks and companies are already doing similar things. For example, PlaceIQ, Placed, JiWire, Millennial Media, xAd and Verve are all using a range of methodologies to measure the mobile-ad impact on offline behavior. Facebook and Twitter are also trying to connect ad exposures on their sites and apps to store visits or purchases.

So Google is doing nothing that others aren’t already doing. The only “issue” here is disclosure of the practice and how Google handles the data.

Smartphone location in the background is “opt-in” for Google. However users may not always know they’re opting in to persistent location tracking. When they’re installed most Android apps have a laundry list of permissions they request, very often including accessing user location (see graphic above).

Most people don’t carefully read Android-install notifications; like software terms & conditions they simply “accept” to install the app and start using it. And general Google services such as Maps, Now and others use persistent location on Android. On iOS there’s somewhat more transparency regarding use of location, with individual apps typically requesting to “use your location” on a case-by-case basis.

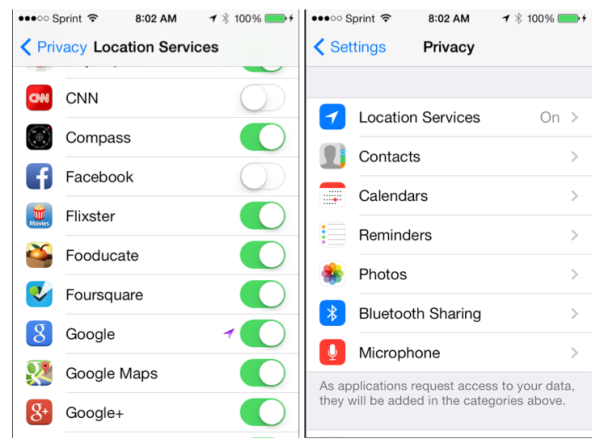

However “location reporting” is largely buried in the settings for the Google Search app on iOS. To find location history and location reporting on Google’s iOS app, you go to settings–>privacy–>location to get to the screen pictured above. Disabling location reporting also disables Google Now features tied to location, which may be undesirable. Apple iPhone users can also disable persistent location tracking under the iPhone’s general privacy settings:

There are similar “global” location controls on Android devices under settings, where location history and location reporting can be turned off or disabled. Most consumers are probably unaware of these controls and their precise functions.

Yet a majority of consumers are sensitive to being tracked by location. According to July 2013 Pew Research Center survey data, 70 percent of respondents said that it’s “very important” or “somewhat important” that they be in control of their location information and who sees it when they access the internet. However surveys from Swirl and Opus Research show that consumers will share location information for access to rewards and unique content.

When consumers understand how and why location is being used they’re more comfortable vs. having a vague sense they’re being tracked. The latter feels more like “surveillance,” “spying” or “big brother.” If they’re included in the conversation it generally becomes a different matter.

The idea that Google is trying to report on the efficacy of mobile advertising is good for marketers. The internet and mobile usage dramatically impact consumer purchase behavior but most of that impact is felt offline and typically invisible to most marketers. Without some sort of modeling or offline tracking marketers are missing this critical offline-impact information.

By the same token Google and others need to be clear with consumers about offline location tracking and how the data are being used. Placed, for example, uses a double-opt-in app (people know clearly their movements are being tracked). Other companies doing similar offline location tracking are to varying degrees providing users with assurances that data are collected and analyzed in the aggregate or anonymously.

Google is merely testing this capability and I’m sure isn’t ready to go public with some announcement — the test was leaked to Digiday. However the company needs to be extra-careful about how it represents what its doing to consumers and go out of its way to explain how to opt-out of location tracking.

Smartphone location tracking isn’t going away. But marketers and trade groups need to get “out in front” of the issue, educate the public and employ best practices. When consumers can understand what’s happening they’re more likely to participate willingly. And when companies are forthright rather than “outed” it’s less likely that the Feds will get involved.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories