Google Launches Plastic “Wallet Card” To Revive Payments Initiative

I won’t fully review the unlucky history of Google Wallet, a product which launched with very high expectations in September 2011. Its key personnel left (or were ousted) and it has effectively been blocked or thwarted by mobile operators with a competing payment product (Isis) that has just been released nationally, with a murky outlook. […]

Google Wallet has also met with public indifference. Accordingly, a year or so ago there were rumors of a physical payment card that was supposed to extend Google Wallet’s reach and use cases. However that launch was reportedly killed at the last moment. Roughly a year later that payment card has finally arrived.

Google has never released Wallet’s mobile usage or adoption numbers — Wallet is a multifaceted product with various functions. However it’s safe to say that the real-world/mobile payments features of Wallet have seen very limited adoption.

Simultaneously the world of “mobile payments” has evolved both in the US and abroad. Square and, to varying degrees, PayPal have had success with their mobile payments efforts. And there are many Square copycats out there.

The underlying technology on which Google Wallet’s offline payments are based, near-field communications, are also now under threat in the US and potentially abroad from competing approaches and technology visions — e.g., bluetooth low energy (BLE) “iBeacons” being promoted by Apple and others. Macy’s in the US is rolling out BLE beacons in some stores.

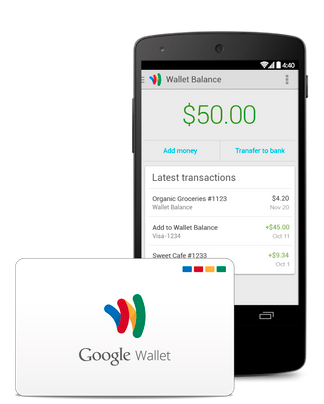

The new Google Wallet Card is a plastic card like a traditional credit or debit card that can be used in stores and ATMs. It draws upon a user’s Google Wallet balance, which can be funded by cash or a credit card. It’s almost identical to PayPal’s similar plastic card in most respects.

There are no fees to use Google Wallet but it can only be used in the US today. Google is promoting discounts and coupons from some merchants to help create incentives to use Wallet. Loyalty programs can also be stored and accessed via Wallet. If Google wanted to drive adoption in the near term it would really “up” the availability and level of those discounts.

PayPal’s plastic card has basically fallen flat. And absent aggressive discounting or other rewards, Google’s Wallet Card almost certainly faces the same prospect in the near term.

Most people with debit and credit cards see no reason to use alternative plastic cards that do the same thing, except perhaps to store and spend cash. As an aside, there’s a very interesting use case around using Wallet as a substitute for a bank account (to send, receive and access money) but these are probably not the consumers Google hopes to attract to Wallet. Indeed, Google might also gain traction outside the US in developing countries with such an approach.

A new crowd-funded effort called Coin hopes to consolidate all physical payment cards into a single card (to make your wallet thinner or smaller). The problem there is that for other than tech early adopters it’s another “solution in search of a problem.” Survey data confirm that while most US consumers expect mobile payments to eventually become mainstream majorities don’t see an immediate need for them.

Where mobile payments are currently gaining traction is in various vertical settings and apps, which operate off a stored credit card. There the benefits of using “mobile payments” are more specific and obvious to consumers. We’ll see many more of these vertical mobile payments scenarios take off (some using PayPal or Amazon as underlying payments options) before we see mainstream adoption of broad, horizontal alternative payments systems like Google Wallet.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories