For Certified Pre-Owned Vehicles, 2014 Is The Year Of Digital Display

A significant opportunity exists for automotive dealerships and digital agencies to capitalize on an explosive market for certified pre-owned (CPO) vehicle sales in 2014. This growth will be driven by a rapidly growing supply of vehicles coming off-lease that make up the majority of CPO vehicles. The rise in CPO inventory in 2014 will be […]

A significant opportunity exists for automotive dealerships and digital agencies to capitalize on an explosive market for certified pre-owned (CPO) vehicle sales in 2014. This growth will be driven by a rapidly growing supply of vehicles coming off-lease that make up the majority of CPO vehicles.

The rise in CPO inventory in 2014 will be accompanied by increased manufacturer support for co-op reimbursements for digital marketing efforts, to include digital display. As such, an immense opportunity exists for dealers to prepare locally-focused digital display strategies to drive awareness of this increased inventory and promote CPO vehicle sales with co-op funds.

Background

A CPO vehicle is a type of used car that has been refurbished and certified by the manufacturer after passing an inspection process. In addition to adhering to strict manufacturer standards, CPO vehicles are often sold with special financing and extended warranties, thus making them an attractive alternative for buyers wishing to avoid costs associated with new vehicles.

CPO sales have trended upward significantly since the inception of this sales practice in the 1990s. However, from 2011-2013, the market for CPO vehicles was handicapped not because of weak demand; rather, it was restricted by limited supply.

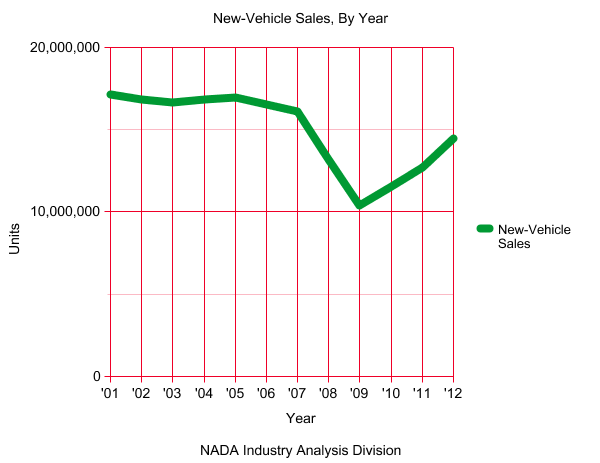

The economic downturn of 2007-2009 resulted in lower manufacturing output. Per below, the National Dealers Automobile Association (NADA) reported annual new-vehicle sales plunged by more than 35% from 2007 to 2009.

The availability of CPO inventory is highly dependent upon the return of leased vehicles. According to Edmunds.com, the average car lease term has been shortened from an average of 42 months in 2003 to 36 months in 2011. Therefore, weak sales during the recession (2007-2009) restricted supply of CPO vehicles in 2010-2013, when the contract terms for vehicles that would have been leased during the recession would have expired.

Also according to Edmunds.com, car leasing has rebounded dramatically from a low of 12% of financing deals in 2009 to 26% of deals in 2011. With this increase in leasing, dealerships can expect to experience a commensurate rise in CPO inventory in 2014.

Co-Op Opportunity

Cooperative advertising, or co-op, is a structure in which the original equipment manufacturer (OEM) will reimburse a percentage of advertising costs within the dealer’s sales territory.

The percentage of advertising reimbursed varies by manufacturer, but can be as high as 50%. While co-op funds have historically been reserved for traditional media such as print, radio and television, an increasing number of OEMs are now covering digital display strategies as well. This trend has been reinforced as OEMs recognize that the majority of auto shoppers conduct preliminary research online prior to visiting a dealership.

Display Opportunity

Digital agencies and dealerships have utilized co-op funding for paid search strategies at an increasing rate over the past year. This has resulted in higher bidding on auto-related keywords, and therefore, an increase in the price that is paid for clicks. This price hike has diminished the competitive advantage experienced by dealerships that were early adopters of paid search strategies. However, digital display remains an underutilized and cost-effective means of generating local awareness and ultimately driving sales.

While dealerships are aware of the use of digital display for new and used vehicle sales, it would behoove local agencies to encourage their clients to allocate additional (co-op reimbursed) resources to creative development and local targeting strategies that will promote the expected increase in CPO inventory in 2014. This increase in resources to boost awareness via well-conceived display strategies will complement and strengthen paid search efforts that are facing increased competition.

Conclusion

As leasing continues to rebound dramatically from the recessionary period of 2007-2009, CPO inventory grows at a commensurate rate. However, such growth in CPO inventory will not be realized until contract terms for these leases starts to expire.

By understanding manufacturing levels and the relationship with lease terms, digital advertisers can work with dealerships to prepare accordingly with locally-focused display strategies designed to raise awareness, complement ongoing paid search efforts, and ultimately drive CPO vehicle sales.

Co-op funds, despite having been available for paid search for the past year, are becoming available for display strategies as well. Such funding should prompt dealerships to allocate resources toward underutilized digital marketing strategies such as digital display.

Co-Authored by Phil Aime, Senior Director National Automotive Sales & Motor Sports Program at Charter Media

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories