European survey finds 70 percent of Android owners want pre-installed apps

Data also show that the majority of Android users customize their home screens.

According to a new European consumer survey from the Application Developers Alliance, 70 percent of respondents would prefer to buy an Android device with basic apps pre-installed. This finding, as well as others in the report, appears to support Google’s argument to the European Commission that its pre-installed suite of apps benefits consumers and is not anti-competitive.

The survey polled roughly 4,000 Android phone owners in Europe, across France, Germany, Spain and Italy, about their app preferences and behaviors. Google is a member of the association and participated in the development of the study according to a Developers Alliance spokesperson.

The study found that “90 percent of Android users customize to their home screen, and only 10 percent leave the suite of apps that comes with the phone untouched.” The report also asserts that Android owners use multiple apps in the same category, not just the top apps or default apps.

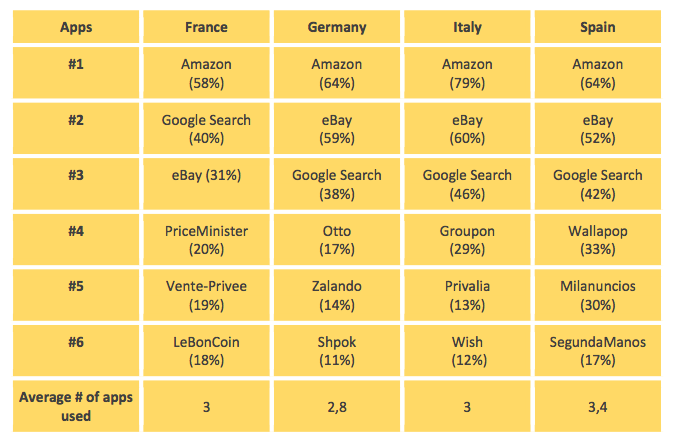

Which apps are used to search, review or purchase a product?

The report paints a picture of Android owners exercising independent judgment and discretion over which apps to use and what to place on the home screen. As indicated, the overwhelming majority of Android owners customize their home screens to varying degrees.

In particular, the survey found:

- 74 percent of Android users move a pre-loaded app off the home screen.

- 52 percent Android users move pre-loaded apps they don’t use into a folder

- 44 percent of users change the default apps in some way (e.g., changing the default search engine, default browser).

- However, 56 percent said they did not change default apps or didn’t know they could.

If you were to buy or receive a new Android device, would you prefer it to come with basic apps so it works out of the box (like an iPhone)?

Overall, the survey shows that Android owners do exercise control over their devices and do make choices about which apps to use, rather than simply relying on “default apps.” However, it also shows Google apps are typically, though not always, in the top three in the categories examined (music, shopping, messaging and so on).

The questions, included in the back of the report, are generally straightforward and unlikely to bias responses, although we might debate the phrasing of the question immediately above: “works out of the box.” The implication is that without these “basic apps,” the phone wouldn’t work. By the same token, another framing of this question, such as, “Would you prefer to control the basic apps that are on your phone or have them selected for you by a third party like the phone manufacturer or your carrier?” would likely produce a very different result.

Nonetheless, the survey findings hold support for Google’s argument that the company’s pre-installed suite of apps doesn’t block competitive apps from making gains or being used. However, many of the competitive apps identified have strong brands or adoption.

A more subtle and difficult question is to what degree the pre-installed apps hinder less well-known or newer competitors from gaining a foothold on Android devices.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories