Contribution margin: How to tell if your marketing makes cents

Is your marketing making you money or losing it? Columnist Jacob Baadsgaard explains how determining and tracking your contribution margin can help your marketing initiatives remain profitable.

You may have heard the old one-liner, “We lose money on every sale, but we make it up in volume!”

It sounds absurd. That’s why it’s a joke, right? But you’d be amazed how many businesses’ marketing policies look a lot like that.

These businesses aren’t deliberately investing in unprofitable marketing — they just don’t know that their marketing is unprofitable.

Why? Because they don’t understand a concept called contribution margin.

Hitting the books

“Contribution margin?” you might be thinking. “I’m pretty sure I slept through that lecture in my accounting class.”

I’ll be the first to admit that bean counting is not the most exciting aspect of running a business. In fact, it can seem a little intimidating at times. But, when it means the difference between profit and loss, those beans are worth counting.

Now, I’m no college professor. My goal is not to put you to sleep with every calculation imaginable. But, as someone who’s put in the effort to understand this subject, my goal is to equip you with the tools you need to decide which marketing channels are worth the money.

The basics

At its most basic level, contribution margin is the difference between the dollars you make from a sale and the costs associated with that sale.

Your costs, however, go far beyond what you spend on marketing. Basically, there are two types of costs you need to consider: fixed costs and variable costs.

Fixed costs are what your company pays just to keep its lights on, whether it’s doing business or not. These are things like rent, utilities and administrative salaries.

Variable costs are expenses that change depending on how much you sell. For example, the more sales you make, the more you’ll spend on fulfillment: product production, shipping, man-hours and so forth.

Contribution margin equals total revenue minus variable costs. So, if you make $500 on a sale and spend $100 to make it happen, then your contribution margin is $400.

Now, there are a lot of ways you can cut down on variable costs, but for the purposes of this article we’re going to assume that you’ve already optimized your fulfillment process as much as possible. Instead, let’s focus on your marketing cost.

The efficiency of your marketing (how much you spend to make a sale happen) can be the deciding factor in whether your company is in the black or in the red.

Visualizing contribution margin

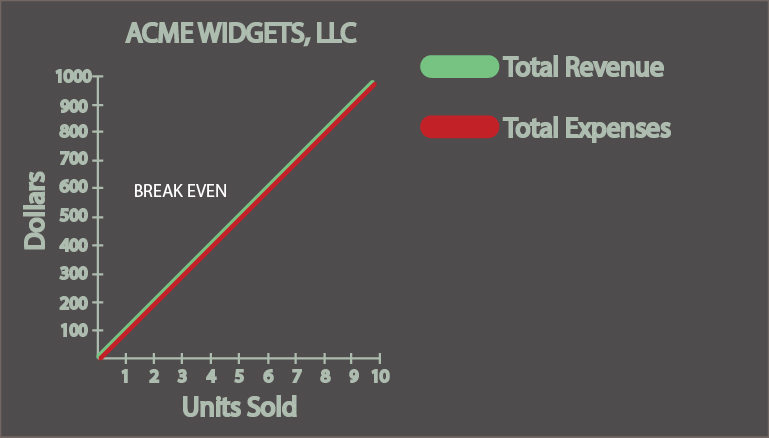

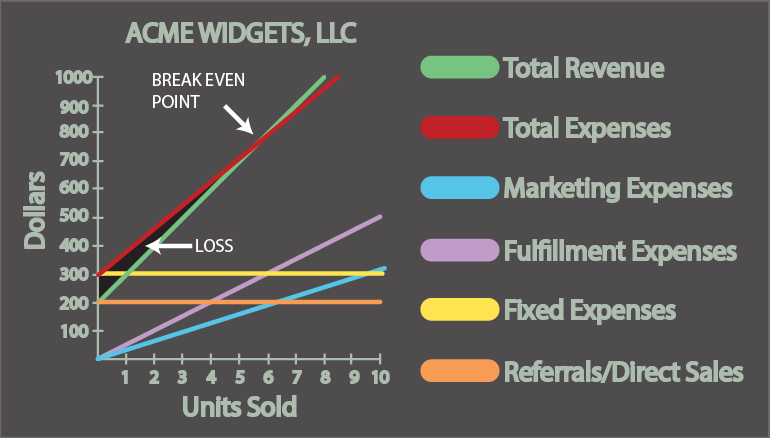

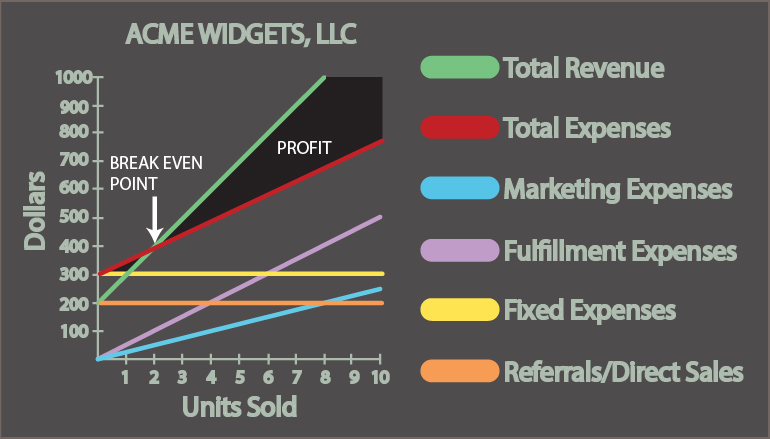

Let me show you how this works, moving from simple to complex. Let’s imagine a small business called ACME Widgets, LLC.

ACME Widgets makes $100 on each widget sold. They spend $500 on marketing and sell five widgets. So $500 of marketing produces $500 of sales.

It’s a 1:1 ratio or a 1X contribution margin, which is a break-even deal, right?

Wrong.

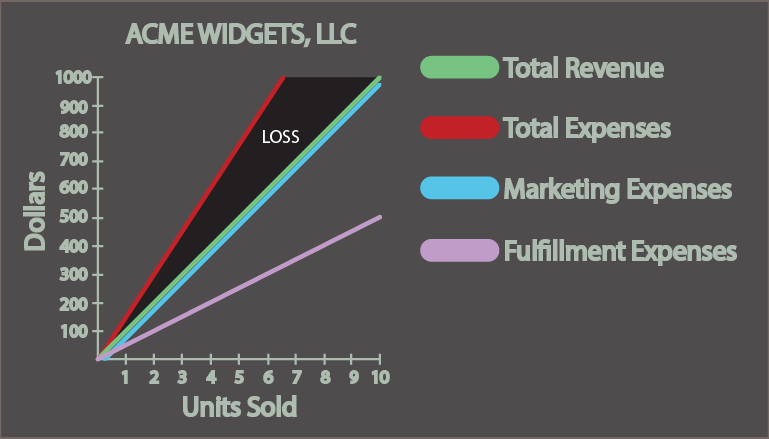

Remember, marketing is not your only cost. If each widget sale costs $50 to fulfill, then ACME actually spends $150 for each sale. That means every sale costs the company $50!

But what if ACME had a more effective marketing strategy?

With a 2X contribution margin, ACME would spend only $50 on marketing per sale made. With $50 for marketing, $50 for fulfillment, and $100 of revenue, the company ought to break even again!

Again, not quite.

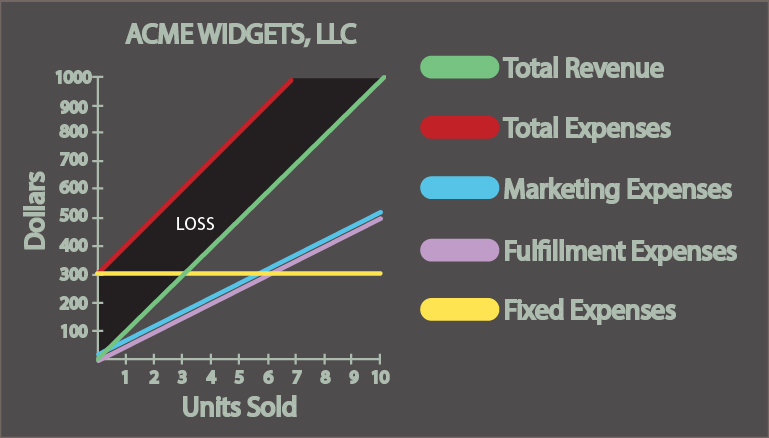

Let’s not forget about fixed costs. ACME spends $300 just to keep its lights on, which means it still loses out, even with a 2X contribution margin.

So, what about a 3X contribution margin, where ACME makes $100 in sales for every $33 it spends on marketing?

At first glance, it looks like it’s still a losing deal. ACME would have to sell whole lot more than five widgets to make money at this rate.

But, luckily for them, fixed expenses are offset somewhat by non-marketing sales (referrals, direct sales due to brand awareness and so on).

In fact, according to a 2015 benchmarking study of companies with at least $2.4 million in revenue, 41.9 percent of their sales came from direct sales and referrals. The other 58 percent of sales came from other (marketing) sources.

So, if we account for a couple of these “bonus” sales ($200), then suddenly, the five marketing sales put ACME Widgets in a break-even situation.

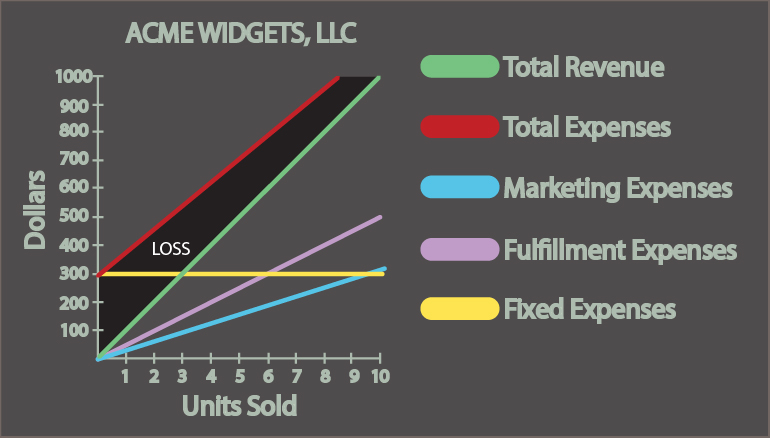

Why stop there, though?

If they’re breaking even at a 3X contribution margin, then optimizing their marketing to produce at a 4X margin ($100 of sales per $25 spent on marketing) would allow them to make some real profit!

Take things to a 5X contribution margin or better, and the gains would be even greater.

Rule of thumb

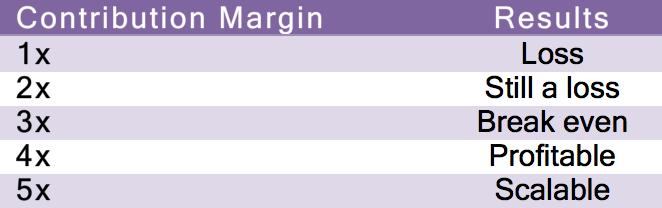

Whew! Getting a little cross-eyed? Let’s take a step back from the charts and figures and boil all this down into a simple rule of thumb.

After working with hundreds of companies, I’ve found the following benchmarks to be an easy way to predict the success of your marketing efforts.

Essentially, it works like this:

- At a 1X contribution margin ($1 of revenue per $1 of marketing), you’re losing money hand over fist.

- With a 2X contribution margin, you’re still losing money on every sale. You can’t make enough sales to fix that.

- A 3X contribution margin is enough to break even.

- At a 4X margin, you actually start to make a profit.

- When you hit a 5X contribution margin or better, you can start using your marketing to fuel the growth of your company.

Simple enough? Good.

Now let’s talk about what you can do with this information.

Increasing your contribution margin

Clearly, a high contribution margin is key to successful marketing, but how do you actually increase it?

The key is to identify which aspects of your marketing are contributing and which aren’t. Get rid of the waste, and your profit margin will improve.

For example, if you are running a paid search campaign, you’re probably wasting 76 percent of your budget on keywords that never produce sales. Simply by redirecting that wasted ad spend into more effective keywords, you can dramatically increase your contribution margin without increasing your marketing spend.

Once you figure out how to get your marketing contribution margin to 5X or better, your marketing becomes a growth engine for your company. For example, with one of my first clients, I managed to cut their their cost per lead by 65 percent. This increased the contribution margin of their paid search advertising from 2X to 6X.

The company poured all of that surplus profit back into paid search, and things simply exploded. Almost overnight, the biggest challenge became finding enough salespeople to field the flood of qualified leads they were getting from paid search. The company grew from 25 employees to a staff of over 250 and made millions in profit.

While not every business can achieve these sorts of results, a 5X contribution margin is reasonable for most marketing campaigns. It simply takes time and resourcefulness.

What is your marketing contribution margin?

If you’re going to reach that 5X contribution margin mark, you need to know what your current contribution margin is. Otherwise, you’ll end up “losing money on every sale, but making it up with volume.”

If your primary marketing channel is internet advertising, where every impression, click, conversion and sale can be tracked, then calculating your contribution margin can be a very exact science. If other types of marketing (event marketing, brand marketing, television ads, yellow pages and so on) are your bread and butter, then you may need to do a little more estimating.

To calculate your marketing contribution margin, you’ll need to know three things:

- Customer Lifetime Value (Click here for help calculating this)

- Marketing sales

- Marketing spend

Once you have these numbers, calculating your marketing contribution margin is easy:

- Divide your marketing spend by your marketing sales to get your cost per sale (e.g., [$5,000 in spend] / [25 sales] = $200 per sale)

- Divide your customer lifetime value by your cost per sale to get your contribution margin (e.g., [$500 LTV] / [$200 per sale] = 2.5X contribution margin)

Once you’ve got your contribution margin, plug it into my rule of thumb. If the number you get is less than or equal to 3, then you need to re-think your marketing — you’re probably losing money.

Conclusion

Like I said before, I’m not a college professor or an accountant. There’s a lot more to contribution margin than I’ve outlined here, but the information in this article should help you determine whether or not your marketing makes sense.

Tracking your contribution margin will take some extra time and effort, but this number will give you a great way to measure the success of your marketing efforts.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories