Mobile Activity In Cities Vs. Suburbs In Massachusetts: What Marketers Can Learn

Like many urban areas, Boston's mobile usage far outshines that in the rest of Massachusetts. Columnist Andrew Waber explains how that patterns like this impact marketers' mobile-focused campaigns.

With a traditionally young and on-the-go population, it may come as little surprise that big cities drive more mobile device usage than suburban areas. Yet, at least in the case of Massachusetts and Boston, the differences are particularly extreme.

Despite a population roughly half of some suburban counties, Boston-area users drive nearly the highest amount of mobile activity among any county in the state, with per capita mobile usage substantially higher compared with suburban areas. The city’s substantial commuter workforce may compound this disparity.

For marketers, these differences are critical to informing a campaign strategy that understands the usage variances between urban and suburban areas.

A Close Look At Mobile Activity Levels

While Chitika Insights has conducted a number of state-oriented studies in the past, the nature of the studies limits the degree of granularity that can be derived from the data. With this latest study, the Chitika Insights team wanted to look at Chitika and Cidewalk’s home state, Massachusetts, to see how localized user bases differed within the seventh smallest U.S. state. (Self-service platform Cidewalk was spun off [PDF] from parent company Chitika earlier this year.)

The results pointed to some significant differences between Massachusetts counties in terms of mobile activity levels.

To quantify this study, Chitika Insights examined tens of millions of Massachusetts-specific smartphone and tablet app-based ad impressions seen through the Cidewalk platform. Using data between March 20 and March 26, all impressions catalogued were subsequently segmented based on the Massachusetts county in which they were generated.

The following data points were generated by also utilizing the accompanying device-level information contained in each impression, along with 2014 Census population estimates.

Breaking It Down

Let’s first examine the share of Massachusetts mobile activity each county generates:

As seen above, users in Middlesex County, which includes Boston-adjacent towns like Cambridge, Watertown and Waltham, generate the largest portion of mobile activity in the state at 20.6%, with island-oriented Dukes and Nantucket Counties responsible for the smallest shares at 0.2%.

Middlesex’s place atop the list isn’t too surprising when viewed in conjunction with its population, which is substantially larger than that of any other county in the state.

Along the same lines, Suffolk’s 20.4% share is particularly interesting. Users in that county, which includes those in Boston, generate nearly the same share of mobile traffic as those in Middlesex County, despite Suffolk County’s population being roughly half of that of the much larger Middlesex.

This emphasizes the major difference between urban user bases, which are much more active on mobile devices as a whole, than those user bases located outside of city centers.

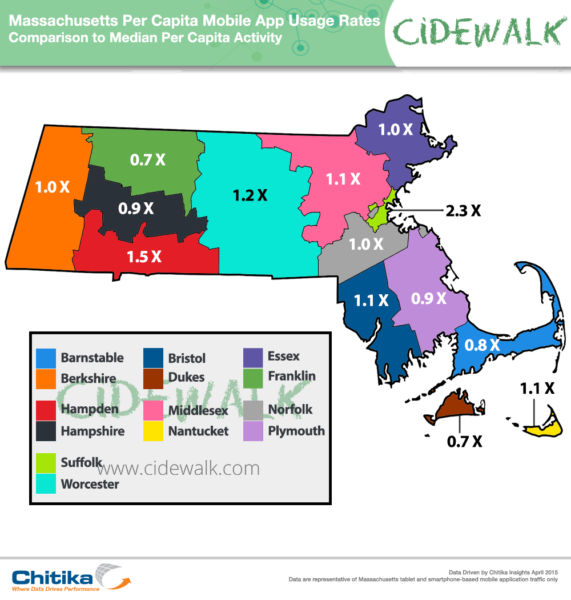

Looking at the impression figures on a per-capita basis drives this point home:

Aggregate per-capita mobile activity from users in Suffolk County is more than double the median per-capita activity level of all counties in the state.

Looking broadly, while the data is not comprehensive, it’s reasonable to assume that the dynamic we see in Massachusetts between urban, suburban and rural areas does provide some useful information when examining the user base dynamics of other states.

Like New York, and other major cities, Boston has a large resident city population, but also a sizable percentage of its workforce commuting in from other, more suburban counties. While users in urban centers are likely to be the most active on mobile devices, this influx of workers tips the scales even further, as prior studies have noted that a sizable percentage of smartphone Web traffic is generated during the workday.

What It Means For Marketers

In this way, marketers need to be keenly aware of the location and timing of their mobile-focused campaigns.

The stats show that a tremendous amount of inventory is available in large cities. However, especially during working hours, active users are likely to be a healthy mix of both native city dwellers and commuting suburbanites.

On the flip side, populated suburban areas are likely particularly intriguing targets later in the day as workers return home.

It’s also worth noting that at least within Massachusetts, smaller cities still drive slightly increased usage rates, although not at the level of their larger peers. Next to Boston-dominated Suffolk County, the greatest per-capita usage rates came from Hampden and Worcester Counties, which contain the state’s third- and second-largest cities, Springfield and Worcester, respectively.

Again, while these dynamics are likely to shift to some degree on a state-to-state level, as a general guideline, a campaign strategy that takes into account these types of area-focused usage nuances can be extremely helpful in maximizing ROI.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories