Big companies are treating Amazon like a branding channel

Big brands are taking a page from smaller upstarts and looking to better understand their customers. Columnist Andrew Waber says the upshot is a shift in ad dollars to Amazon Marketing Services and similar ad products.

Big brands have been talking for an awfully long time about “acting nimbly” and instilling a “startup culture.” There’s a recognition that being data-focused and able to act quickly will help spur short- and long-term success.

But one of the most remarkable things about 2017 was that it was the year big companies — particularly CPG (consumer packaged goods) brands — actually started to act like small companies when it came to certain aspects of their marketing strategy and decision-making.

A recent eMarketer report outlined this in detail. CPG brands have started inserting themselves at more points throughout the buyer journey, rather than focusing their efforts almost solely on brand awareness or retailer-led promotions. This has manifested itself particularly in the form of targeted advertising, social media strategies and a restructuring in how ecommerce product pages are managed.

Smaller brands have attracted loyal customers using these techniques over the past several years, and larger competitors are taking notice. What these smaller upstarts keyed in on was that consumers attach a tremendous amount of value to a brand that personalizes its content to speak more to them, and doing so creatively won’t break the bank. Their inroads have spurred bigger competitors to act.

What’s the end result? We’re seeing ad dollars from these big brands shifting toward Amazon Marketing Services (AMS) and other retailer-oriented, direct-response type advertising.

Large grocery brands, which may have relied on loyalty card data for high-level targeting in the past, are now migrating to a combination of first- and third-party data to better understand their customers at a granular level and provide them relevant messages — e.g., targeting consumers with different product types based on the weather.

A move from mass marketing to personalization

This shift in thinking, from a single mass market to a fragmented personalized one, shows brands’ recognition that the buyer journey for even everyday things like groceries has fundamentally shifted.

eMarketer estimates that roughly 90 percent of US grocery sales are still made in the store, but also that 90 percent of US internet users are “researching CPG products at least some of the time before making purchases, whether online or in-store.” This is a trend that’s only going to get more urgent for brands to address.

With consumers very comfortable researching grocery products online, regardless of how they ultimately buy, larger brands are also taking a page from smaller players by making their product pages marketing vehicles, rather than sales vehicles.

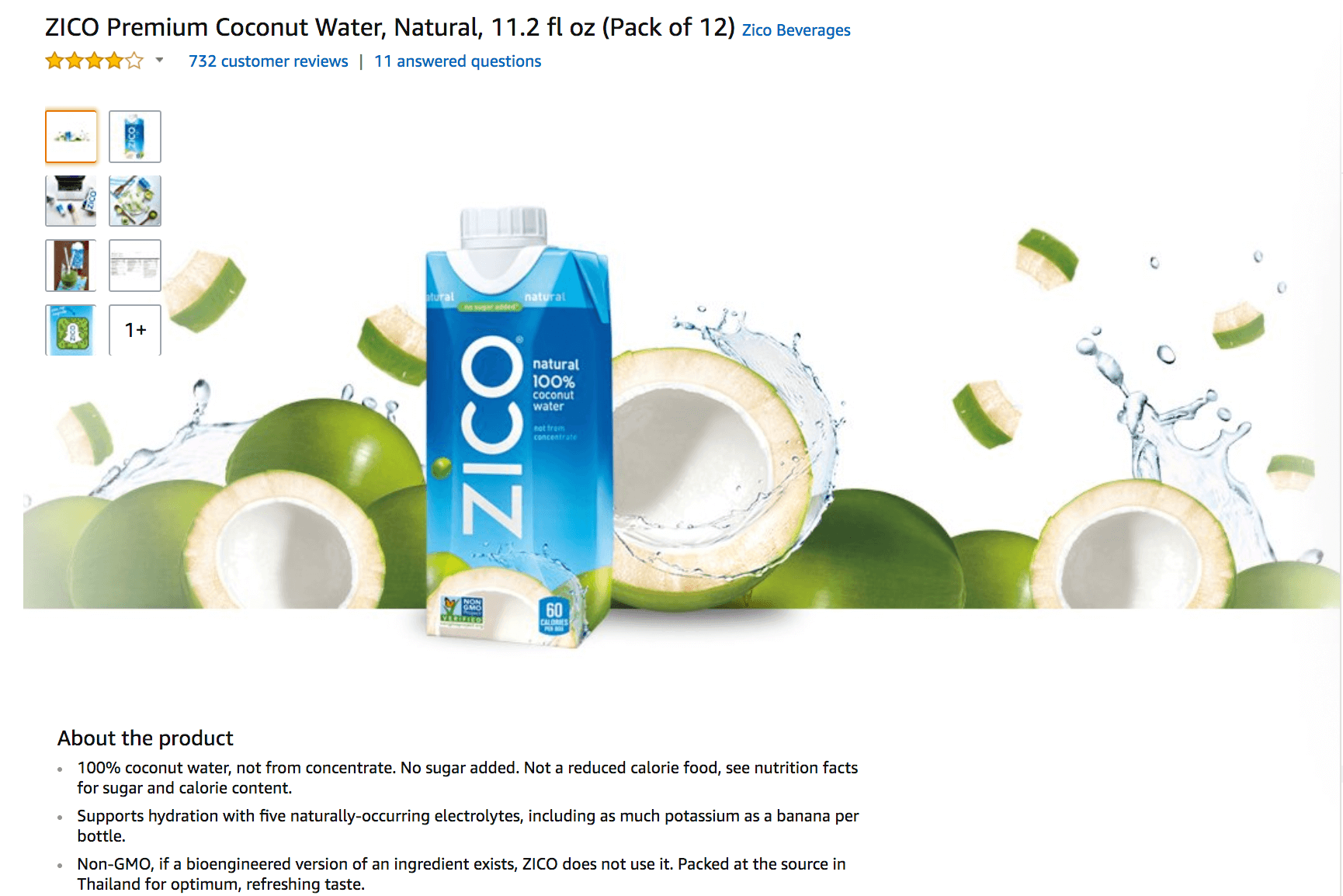

This has meant greater investments in product imagery and keeping marketing copy fresh and relevant. As one example, Coca-Cola’s Zico coconut water page on Amazon is full of vibrant photos, almost philosophical written copy and a lot of focus put on “when to buy” coconut water.

Ad dollars moving to AMS and similar ad products

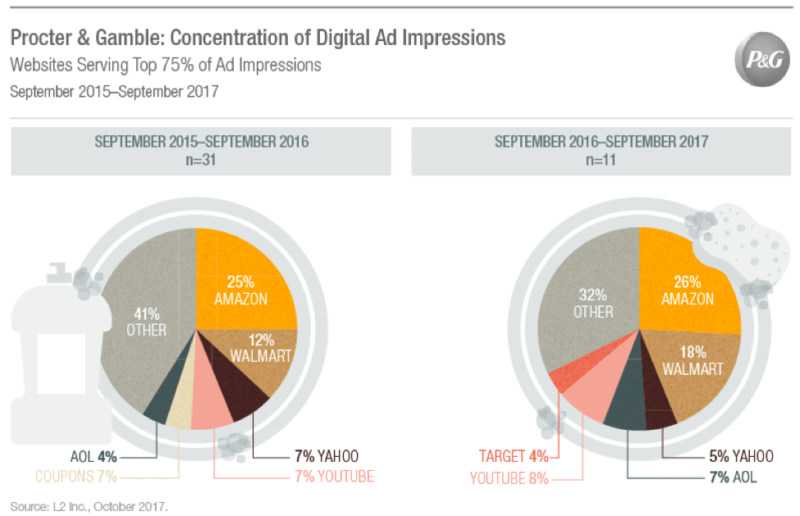

That’s why we’re seeing advertising budgets moving toward AMS and similar retailer-oriented, direct-response kinds of advertising. According to an L2 analysis of Procter & Gamble online advertising impressions, the percentage of P&G ads going to ad products directly tied to retailers rose 29.7 percent year over year — that’s out of a marketing budget of around $2.4 billion.

These are ads that, by their nature, are brand-safe, and thanks to linking directly to product listings, they are easier to map to return on ad spend than awareness-focused buys or traditional RTB (real-time bidding)-style units.

What’s ahead for large CPG brands?

So, what’s next for these larger CPG brands? At a high level, expect AMS and similar ad products to continue their significant rates of growth.

Every CPG manufacturer that sells online should be trying out retailer-run ad products. Allocating resources to these campaigns will help brands better optimize channels and associated ads and identify which kinds of products perform well within a target market.

Additionally, brands will commit additional resources to data collection and associated analytics technologies to make insights on ecommerce and other online platforms actionable.

The concept of what makes a great product page or product experience is inherently fickle based on trends, industry, price point and myriad other factors. The market only stands to get more sophisticated, and big brands will be under pressure to be as informed as possible as they speed up their decision-making.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories

New on MarTech