Apple Beats Expectations With $58 Billion In Revenue, Sells 61 Million iPhones

The iPhone 6 is the force that continues to power stellar quarters for Apple. This afternoon is no exception. The company reported Q2 revenues of $58.01 billion and quarterly profit of $13.6 billion. Financial analysts had projected revenue of $56.1 billion. A year ago revenues were $45.6 billion. Apple sold 61.2 million iPhones last quarter […]

The iPhone 6 is the force that continues to power stellar quarters for Apple. This afternoon is no exception. The company reported Q2 revenues of $58.01 billion and quarterly profit of $13.6 billion.

Financial analysts had projected revenue of $56.1 billion. A year ago revenues were $45.6 billion.

Apple sold 61.2 million iPhones last quarter compared with expected sales of 58 million. Apple has now sold over 134 million iPhones in 2015. Once again, however, the company sold fewer iPads than expected (12.62 million vs 13.6 million). It also sold somewhat fewer Macs (4.56 million) than anticipated — though sales still outpaced the broader industry.

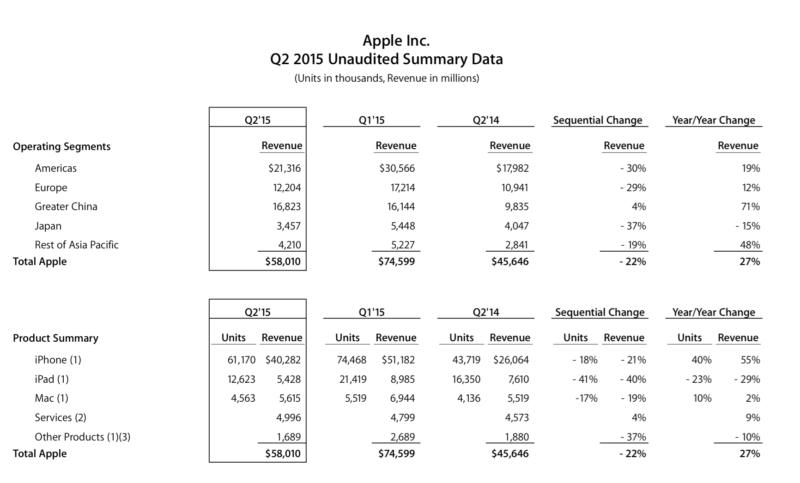

Unit sales for Q2:

- iPhones: 61.2 million units, $40.3 billion in revenue

- iPad: 12.6 million units, $5.4 billion in revenue

- Macs: 4.56 million units, $5.6 billion in revenue

- Services: $4.99 billion in revenue (quarterly record)

- Other: $1.7 billion in revenue

Non-North American sales were responsible for roughly 63 percent of revenue, $16.8 billion of which came from China. That was second only to the Americas region, which generated $21.3 billion.

Apple has $194 billion in cash on hand. The company projected Q3 revenue between $46 billion and $48 billion. Its stock is currently up in after-hours trading.

Selected notes and comments from the earnings call:

CEO Tim Cook: Number of locations accepting Apple Pay has tripled. Best Buy is the latest retailer to adopt. You can now use Apple in a number of hospitals.

Apple is now responsible for $600K jobs in Europe. New European data centers will run 100 percent renewable energy. And most of the company’s operations are run off renewable energy.

“We’re happy with customer response to the new MacBook” (reviews have been mixed). Touts HBO Now on Apple TV. One of the top apps in the US.

Apple Watch: The public’s response has been overwhelmingly positive. There are 3,500 apps already available (not Facebook however).

CFO Luca Maestri: Q/Q revenue growth was 27 percent. Greater China performance was especially impressive, due to stronger than expected iPhone results.

iPhone sales showed 40 percent Y/Y growth. Average unit sale price $650+.

Mac sales grew 10 percent Y/Y.

New records for iPad sales in China and Japan. “More muted [sales] in other markets.”

Retail: 21 stores in Greater China, moving toward 40.

Financial analyst questions/answers:

Question re iPhone switchers — Tim Cook says lots of first time buyers (emerging markets) and Android switchers among iPhone buyers this past quarter.

Question about whether the Apple Watch is selling well — Tim Cook says “demand is greater than supply.” The company is working to speed up delivery of pre-orders. By sometime in late June we anticipate being able to sell the Apple Watch in new countries.

We’re far ahead of where we expected to be from an applications point of view. When iPad launched there were only 1,000 apps vs. 3,500 for the Apple Watch. “We’re learning quickly about customer preferences . . . we’re making adjustments . . .”

Question about iPhone market share growth — Tim Cook says that the coming quarter looks “very very good.” Doing well with both switchers and first-time buyers. About 20 percent of “active [iPhone] installed base has upgraded to iPhone 6/6+,” suggesting “plenty of upside” still to come.

Another question about the Watch, expressing skepticism about sales/demand — Tim Cook says he’s “thrilled” with the market’s response to the Apple Watch. He adds that customer response is “close to 100 percent positive; it’s hard to imagine it being better.”

Cook attacks third party analysis of Apple costs and margins for its products.

Question re demand in China: Demand for iPhone up 70 percent Y/Y in greater China. That suggests 9 points of market share gain (per Kantar Y/Y). The Mac also had an “unbelievable quarter in China” — up 31 percent. App store in China grew over 100 percent Y/Y. Everything in China was “extremely good.”

Apple investing heavily in retail and infrastructure in China. Payments to developers in Greater China of more than $5 billion, over 50 percent of which is past 12 months. Bulk of sales to Chinese middle class.

Question about reinvigorating iPad growth — Tim Cook says that “we are seeing cannibalization [of the iPad] from the iPhone 6 plus — and from the Mac.” He says he has little concern about that. “The underlying data” look better than overall sales. First time buyer numbers in US and China are very good. “We also see usage numbers that are off the charts.”

We believe the iPad is an “extremely good business over the long term.”

Question re whether the iPhone is too expensive for emerging markets — Tim Cook says BRIC countries were up 64 percent Y/Y . . . “sales have to be coming from middle class” in those countries. “You can’t generate those kind of numbers without getting significantly into the middle class.”

Question re HBO Now and similar products – Tim Cook says, “We’re marrying their great content and our great products and ecosystem . . . there’s a lot of traction in there.”

We’re in the early stages of “major changes in media for consumers and Apple can be a part of that.”

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories