5 Ways Paid Search Can Support SEO In Retail

Digital marketing is quite the fragmented landscape; modern marketing channels can be so complex that they often require dedicated specialists. But who is looking at the bigger picture when your team members are mono-focused on one discipline? I find this especially worrisome in the world of organic and paid search, which play in the same sandbox […]

Digital marketing is quite the fragmented landscape; modern marketing channels can be so complex that they often require dedicated specialists. But who is looking at the bigger picture when your team members are mono-focused on one discipline?

I find this especially worrisome in the world of organic and paid search, which play in the same sandbox but rarely converse. While search engine optimization (SEO) teams are struggling to find reliable reporting tools, many don’t realize they are (figuratively or literally) sitting next to a paid search counterpart with a mound of actionable data at their fingertips.

Here are five ways paid search data can support SEO:

1. Landing Page Arbitrage

The idea behind “landing page arbitrage” is to identify pages that are performing well in one search channel but not the other. Very often, this results in an actionable item for the channel lagging behind.

In this case, the SEO professional doesn’t even need to tap the shoulder of the person managing paid search. He or she only needs to consult the landing page report on Google Analytics, which makes it easy to compare sales between paid and organic search. (In the next four sections, the SEO professional will need access to AdWords data.)

Let’s look at a real-world example. For a formal men’s apparel retailer like JoS. A. Bank, [men’s suits] is a key search term for both its SEO and PPC teams. They’ve done a great job locking down high ranking organic and paid search positions on Google.

However, upon closer inspection, I found the company’s SEO and PPC teams are sending search engine users to different landing pages.

The SEO team is sending users to the site’s main category page for men’s suits, which makes sense since it’s a highly competitive term and it’s easier to rank with a page closer in hierarchy to the homepage. The SEO landing page looks like this:

Since the SEO team has to juggle optimizing the page for those navigating to it from on-site links as well as those entering from organic search, they’ve opted for a version that suits (pun intended) the on-site browser more than the off-site entrant.

The paid search team, on the other hand, does not have to balance on-site visitors with search entrants, so they’re using a page that jumps right into product. The PPC landing page looks like this:

Since the PPC team does not have to balance on-site navigation with new search visitors — and they can more freely test landing pages — I’m going to assume the JoS. A. Bank PPC team has tested both options and that this landing page performs better for search entrants.

This fact could be useful for the PPC team’s SEO counterpart.

If I were leading the SEO team, I’d want to know how much better the second landing page out-performs the first in paid search. Is it worth coordinating an A/B test to find out if a list of suits outperforms the category-type navigation in the first landing page? Should I consider a hybrid of navigation and product, because currently there are no products for sale at all on my landing page?

Since the SEO’s landing page has to serve as a category page as well as a landing page for organic search, they’ll have to A/B test the page for all of its functions and weigh the pros and cons of each option. However, organic search visitors are likely to have a huge impact on the page’s ability to drive sales.

Strategic changes to the SEO landing page could result in a significant lift in conversions — and when you consider that this page is the first organic result for “men’s suits,” this could have tremendous impact on customer acquisition and revenue. Unfortunately, when marketing channels are working independently of each other, this sort of an analysis often gets swept under the rug.

2. Brand Term Nuances

In 2013, Google quietly started hiding referring keywords for organic search visitors, citing privacy concerns. Sadly, SEO teams are still suffering from this loss of transparency.

One place where I find this change really impacts marketing efficacy is with the nuances of brand terms. Brand terms show the highest level of intimacy with your company and almost always have the highest economic value to your business. Luckily, the nuances in brand terms lost to the SEO in Google Analytics can easily be replaced by running a paid search terms report on a brand campaign in AdWords.

Here’s a quick list of “brand keywords” that ecommerce players often handle poorly:

- Brand name coupons

- Brand name promo code

- Brand name reviews

- Brand name returns

- Brand name scam (for the more disreputable players)

- Brand name vs. competitor

- Brand name sale/deals

Each of these brand term modifications comes from a user with a very different intent than someone simply searching for your site.

Good PPC teams have campaigns in place that use modified broad match keywords to catch all these searches. Great PPC teams send users with these brand term nuances to a query-appropriate landing page. In either case, the search term data exists, and SEO teams can easily overlook this opportunity.

Both the PPC and SEO teams should prioritize brand terms and guide any search experience around them flawlessly. If your search teams don’t direct users to a page that helps them find what they’re looking for, they’re going to leave your site to find it. It’s not enough to rank well for these terms; you also have to direct users to the appropriate page to maximize their value.

3. Competitor Identification

Often times, executives like to define their own competitors rather than listen to an increasingly complex market, but anyone who has run search campaigns can tell you that competitors defined in a boardroom are not always the ones you find in search engine results.

For example, it’s easy to see why the CEO of Verizon would consider the team at AT&T his mortal enemies. But to search marketing professionals, Skype could be an equal — or even greater — adversary for terms like “international calling.”

You can flip a PPC ad on in a matter of minutes, while achieving first-page, organic results for major terms can take months or even years. For this reason, and because your competitors don’t always focus on the same channels, these two disciplines aren’t always competing with the same organizations.

However, PPC competitive reports can help SEO teams spot new and aggressive competitors that they should consider monitoring. The easiest way to do this is to pull an Auction Insights report on a regular basis and keep an eye out for new market entrants.

4. Product Level Data

It’s rare that the interests of SEO and PPC teams line up perfectly, and sometimes their interests even appear to be at odds. But that’s not the case with product titles, which are important for both camps.

On most ecommerce platforms, the product title drives four really important ranking factors: the URL key, the H1 tag, the title tag, and the product title in Google Shopping.

The URL key, H1 tag, and title tag are three of the biggest on-page factors for SEO, while the product title is the primary way Google auto-targets your ads on Google Shopping. (It also serves as a headline that can affect click-through rates.)

Similar to landing page arbitrage, I suggest SEO and PPC teams take a look at organic and paid search data by product to see what opportunities exist. These situations generally signal an opportunity for optimization:

- Good sales via SEO but not PPC

- Good sales via PPC but not SEO

- Good overall sales, but bad in both PPC & SEO

In many cases, these issues can be addressed by simply tweaking the product’s title tag.

5. Search Term Data

As I mentioned earlier, Google recently started hiding referring keywords for organic search traffic; however, referring search query data is still alive and well in PPC. One way SEO marketers can use this data is when they’re prioritizing the keywords and landing pages that they’ll focus on.

What is the estimated economic impact of increasing your rank for certain keywords? Let’s take the search term “three piece suits” as an example. Here’s what Google’s keyword tool would give us:

According to Google’s keyword tool, “three piece suits” is searched roughly 390 times per month. But, that’s the exact term.

If we had access to a tightly knit ad group that targeted variations of the keyword “three piece suits,” we would be able to much more accurately predict what search volume really looks like. This kind of an ad group would probably contain few keywords such as these:

[three-piece suits]

[3 piece suits]

+three +piece + suits

Calculating the true search volume of these keywords in the last 30 days using AdWords is relatively easy. First, take a look at the total impressions your ads received for that ad group. Then, pull up the auction insights page as shown below.

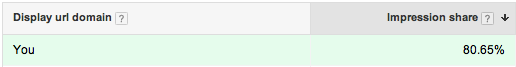

When we get to the Auction Insights page, we’d see a number like this:

Now, we have our impressions as well as our share of the total number of impressions. We can calculate a better estimate of the total number of searches in the last 30 days by dividing our total impressions by the impression share.

Let’s say our total impressions for the ad group was 3,000. The calculation would look like this:

3,000 / 0.8065 = 3,720

Now, we know the search volume for that collection of keywords is really in the ballpark of 3,700. Remember Google’s 390 estimate? This is a much better way of finding and prioritizing keywords for an SEO, when he or she has access to a PPC counterpoint. It’s just a matter of having both teams talk to each other.

But why stop there? It’s not enough to shoot for keywords with the highest search volume; great SEO professionals shoot for keywords with the highest economic impact. That takes a few more steps:

Since we are using a fictitious example, let’s take this a step further and make up a conversion rate, an average order value, and a projected click-through rate.

- Conversion rate: 2%

- Average order value: $600

- Projected click through rate: 5%

For real-life applications, you should pull conversion rates and average order values directly from AdWords. Projected click-through rate will always be a rough estimate, and will vary greatly based on what your SEO employees think they can reasonably achieve.

Now that you have your numbers in place, you can project the monetary value of the landing page with three more relatively simple calculations:

Search Volume x Projected Clickthrough Rate = Projected Clicks

3,720 x .05 = 186

Conversion Rate x Projected Clicks = Projected Orders

186 x .02 = 3.72

Projected orders x Average order value = projected value

3.72 x 600 = $2,232

These estimates are far from perfect, and they should be taken with a grain of salt because you’re forced to make several assumptions that may or may not hold true. They also assume the value of a page is based just on the first order; some more calculation would be necessary to determine a lifetime value.

Still, this process is a great way to determine the true economic value of ranking well for a given topic or product type – certainly better than the tools Google currently has at an SEO’s disposal. It’s also a great first step for getting your PPC and SEO employees back on the same team.

Contributing authors are invited to create content for MarTech and are chosen for their expertise and contribution to the martech community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories